Merriam-Webster defines a “frenemy” as “one who pretends to be a friend but is actually an enemy.” It may sound like something out of the movie, “Mean Girls,” but really it emerged in the 1950s to describe the complicated U.S.-Russia relationship.

Many retailers and apparel brands describe their relationship with Amazon on frenemy terms. For any B2C company, the adversarial relationship with Amazon is understandable—the online giant has been disrupting the retail industry for the last two decades. But to be fair, Amazon has also allowed brands to use them as another sales channel by creating branded stores within their ecosystem. Brands are stuck between loving the revenue that comes from selling through Amazon’s platform and hating the fact that Amazon is contributing to a reduction of foot traffic in their brick and mortar locations, as well as shrinking revenue per square foot.

The question then becomes: How do I conquest Amazon’s customers without cannibalizing the people who are buying my products on Amazon? The answer: Understand Amazon’s customers as well as they do.

Amazon sits on a treasure trove of consumer data that helps them retain customers by staying relevant. Nearly 190 million people have shopped on Amazon within the last six months, and nearly half of them are Prime members. Over 11 million people are Subscribe and Save users; 10.6 million are Amazon Pantry users; and there are 3.1 million Amazon Fresh users.

Amazon knows what products and brands people are buying on the site. Any brand that plans to go after Amazon’s customers without stealing customers from their own Amazon store should also know what products and brands people are buying from Amazon.

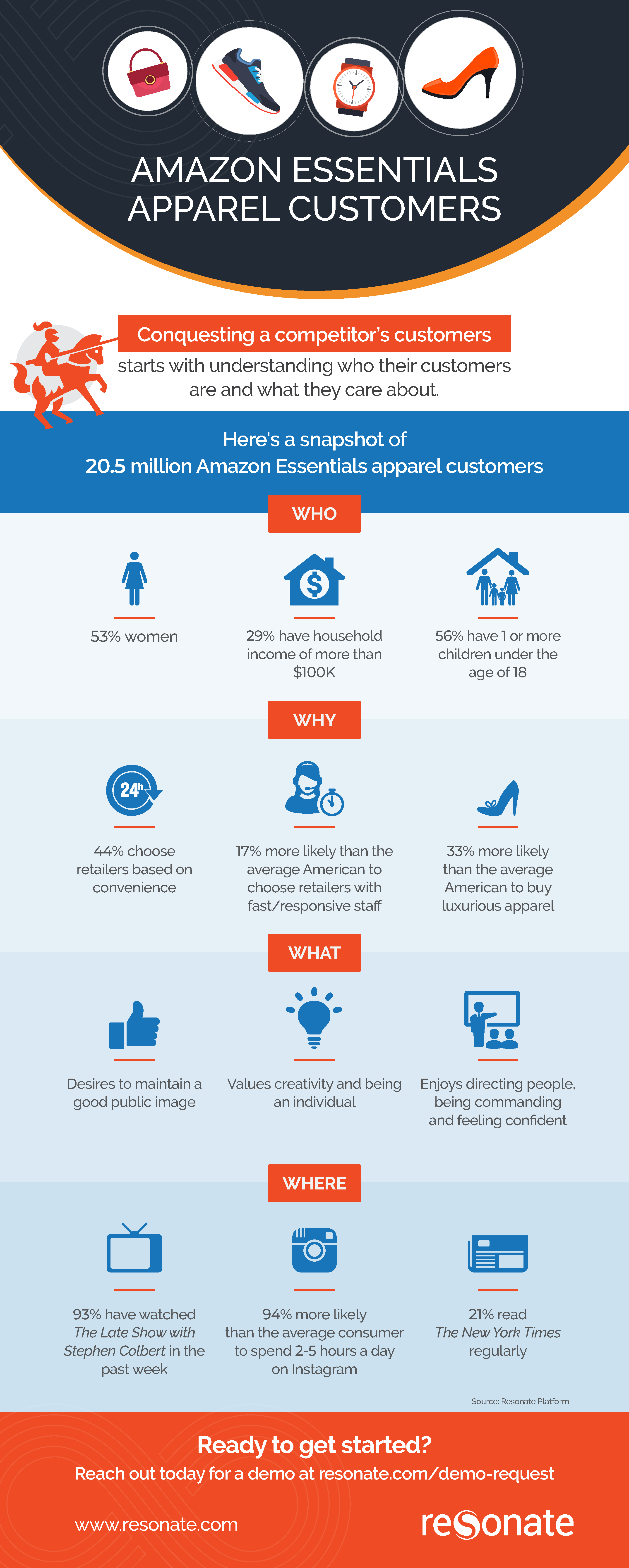

For example, let’s look at people who buy Amazon Essentials apparel—Amazon’s clothing brand. If you knew who was buying Amazon Essentials apparel and understood why they chose to buy this brand, you could create a strategy for how to conquest these consumers. By conquesting the people buying this apparel and not the people buying your brand’s products, you can ensure that you’re acquiring new customers and people already buying your products. With the right information, you can determine how to connect with these consumers on an emotional level and give them the offer that’s most likely to get them to engage and convert.

In looking more closely at people buying Amazon Essentials apparel, you’d expect bargain-basement shoppers who buy solely based on price. The data paints a different picture: They’re busy professionals who value convenience and saving time and enjoy wearing luxury apparel. These shoppers are predominantly women with children and are driven by living an exciting life. Unsurprisingly these professionals like directing people, being in charge and maintaining a good public image. They also want to acquire wealth and influence. If you’re looking to find them in the morning, they’re reading the Chicago Tribune. In the evenings, they’re watching Taken and spending the rest of their free time on Reddit.

Want to learn more about Amazon’s customers? Or is there another competitor whose customers you’d like to conquest? Reach out for a demo of how our insights can help.