With COVID-19 affecting consumers’ daily routines, it’s also affected the way many people consume media.

As you well know by now, everyday life has completely changed in the last six weeks. Consumer routines look much different than they did at the beginning of March. Whether they’ve had to postpone a vacation, or your kids are now home 24/7, the daily routines of consumers are changing and, as a result, so is their media consumption.

There are varying reports of how the global pandemic is affecting podcast listenership. According to iHeartMedia, listenership for the iHeartPodcast Network is up six percent month-over-month, and that number is even higher in markets where governors announced shelter-in-place orders, with listening up 13% in California and eight percent in New York state in just one week. However, according to a study done by Edison Research and Triton Digital in 2019, 52% of monthly podcast listeners say they listen to podcasts when they drive. Many consumers aren’t commuting to work or school as offices and schools around the country have closed and people aren’t traveling anywhere, so those listeners have likely also dropped off. Many consumers’ interests have also shifted their listening preferences to media and entertainment/pop culture podcasts over news and politics, likely as a way to escape from the stress of these tough times.

We looked at two specific groups, those who have increased their podcast listenership since stay-at-home orders began and those who have decreased their listenership. For those listening more, it’s important media companies get to know them so they can retain them once life begins to get back to normal. It’s also equally important to get to know those who don’t listen anymore in order to get back them on the bandwagon. No matter which segment is more critical, gaining a deep understanding of your listeners gives you a competitive advantage over other media companies in terms of advertising and content production. A comprehensive, dynamic view of your listeners will not only help you create more resonant content, but it will make you a more valuable advertising partner.

CONSUMERS WHO HAVE INCREASED THEIR PODCAST LISTENERSHIP

This group noted in our Connected Flash Study, which measures consumer sentiment surrounding COVID-19, that they’ve increased their time spent listening to podcasts, and they listen to podcasts between 1-6 hours each week. They’re mostly single female students ages 18-24 who’ve completed some college and have no children. Their semester was probably cut short, leaving them with plenty of time to listen to podcasts more often. When it comes to their personal values, they over index for showing their abilities and being admired, living a life full of excitement and the freedom to be creative. All of these values align with a college student looking for adventure and getting ready to launch their career. They want to be praised and recognized for their success. They’re motivated by their social/professional status and romantic love.

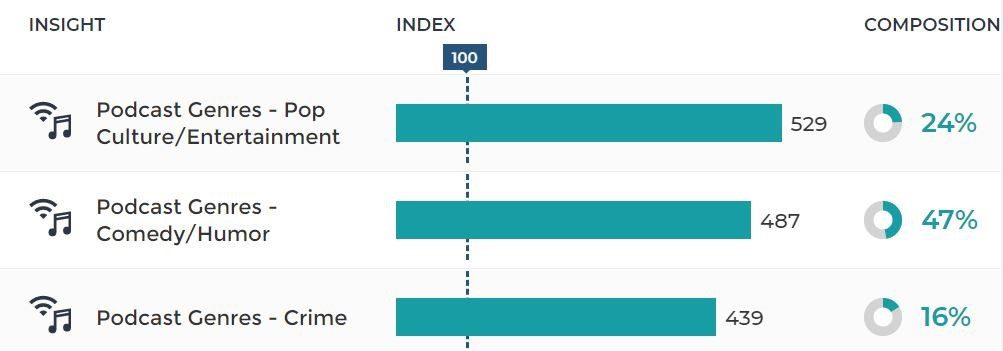

What kinds of podcasts does this group listen to? They’re 4X more likely than the average U.S. consumer to listen to pop culture/entertainment podcasts, 3.9X more likely to listen to comedy podcasts and 3.4X more likely to listen to pods related to crime. Consider offering a pop culture round-up podcast mixed with humor or a true crime podcast focusing specifically on celebrities. If you already have something that might pique their interest, make sure you’re targeting them across the digital touchpoints they spend the most time on to get them to tune in. Their top social media channels are Tumblr, Tik Tok and Reddit, so consider connecting with them on of those touchpoints in order to increase customer lifetime value (CLV).

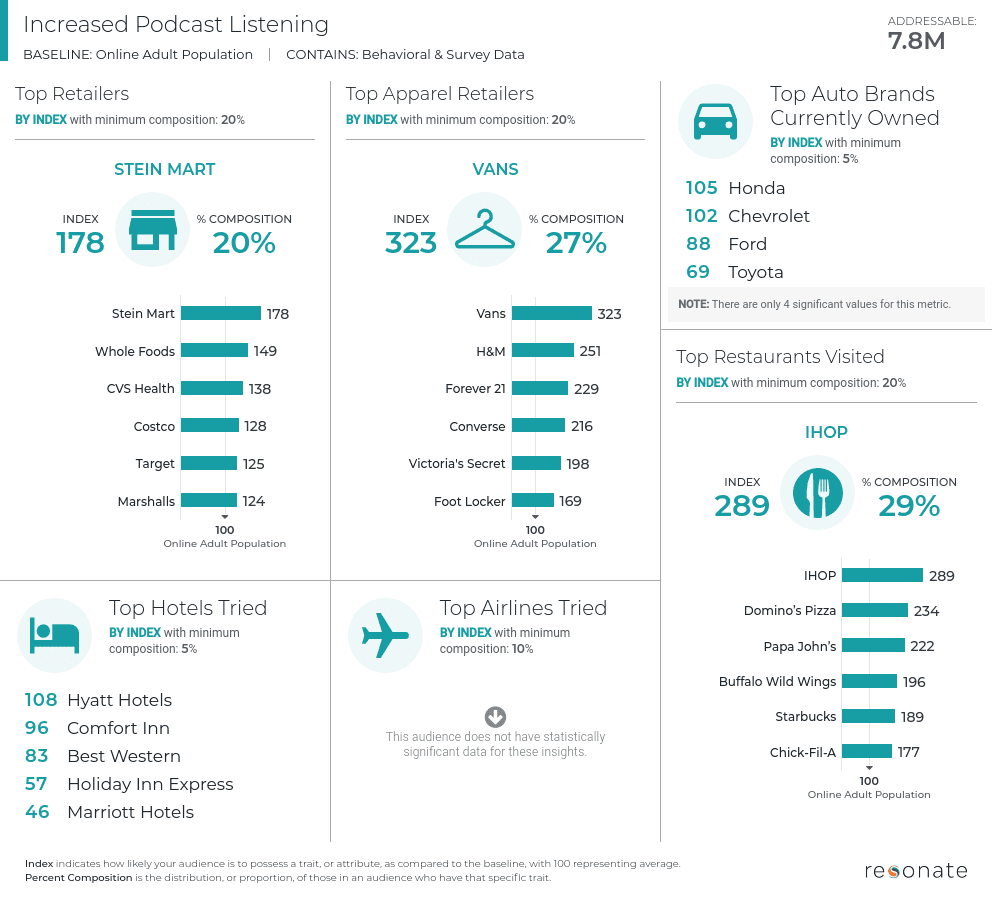

Beyond content creation, it’s important to know what brands and retailers your listeners prefer. Showing potential advertisers that your listeners already have an affinity to their brand will not only make them want to do business with you, but it will set your company apart for having such a deep understanding of who they are beyond podcast listeners. It will also be a helpful clue for other advertisers to understand the kinds of companies they prefer and open your podcast network up to new advertising opportunities.

According to Resonate’s brand affinity curated report, their top retailers are Stein Mart, Whole Foods and CVS Health. Their favorite apparel retailers are Vans, H&M and Forever 21. Work with one of these brands or retailers to offer your listeners a special discount for a limited time. Advertisers will appreciate the fact that these listeners have a pre-disposed affinity towards their products and services, making it an easy decision to do business with you.

CONSUMERS WHO HAVE DECREASED THEIR PODCAST LISTENERSHIP

This group, once regular listeners, haven’t been tuning into podcasts as often. Whether it’s because they’re no longer commuting or they don’t have time between balancing work and kids at home, having a deeper understanding of their content and brand preferences will help you win them back.

This group is mostly made up of married women ages 25-34 who are unemployed with at least one child. Since this segment is out of work and dealing with their children being at home on a daily basis, they likely don’t have the time they used to have to listen to podcasts. When it comes to personal values, this group over indexes for avoiding harming/upsetting people, caring for family/friends and being in charge and directing people. They’re personally driven by their faith, trust from others and living an exciting life. These values and drivers clearly show that the most important thing in their life is taking care of and helping others.

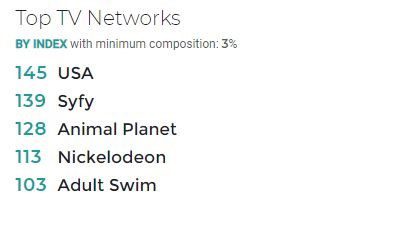

When it comes to podcast genres, this group is least likely to listen to politics, news and crime. Since they don’t listen to podcasts very often, we looked to some of their other media consumption habits to see what kinds of topics they might be interested in. Their top TV networks are USA, Syfy and Animal Planet, and their favorite TV shows are Van Helsing, Runaways and The Purge. They clearly enjoy science fiction and superhero content, so perhaps a podcast more along those lines would entice them. When it comes to the types of online videos they watch, they prefer games and arts & entertainment contentBased on their other media preferences and their lack of interest in news and political podcasts, they view media as a chance to escape from reality, so bear that in mind when you’re trying to re-acquire this group of listeners.

CONNECTING WITH TWO DISTINCT GROUPS

If you plan to focus your efforts on the one group that has increased their listening, it’s important to understand their brand and retailer preferences so you can leverage this increase and adjust your advertising strategy. If you’re looking to reacquire the group you lost due to the impact of COVID-19, focus on creating content they can listen to as a form of escape. This segment is busier than ever with their family at home and is facing financial challenges, so they’ll appreciate you bringing them content that allows them to de-stress.

Want to learn more about consumers during the COVID-19 crisis? Download our just released report: Understanding U.S. Consumer Sentiment During the Coronavirus Pandemic.