Be honest: how many of you binge watched Schitt’s Creek this year? We’re going to guess more than a few since streaming TV viewers are 45% more likely than the average consumer to say following a TV show is one of their top hobbies.

Streaming has been part of everyday American life for a few years now with phrases like “Netflix and chill” working their way into the vernacular and colleagues asking, “What did you watch this weekend?” as if binge-watching is the expected baseline. So, it’s no surprise that…

99.2 million Americans have a streaming TV subscription

That’s a group of the population that is growing monthly — particularly over the last 10 months. In the early days of the pandemic, as in July, a lifetime ago it seems, we looked at increased streaming as it was related to data we began collecting in March. And now…

80 million Americans have INCREASED streaming during the pandemic

That number is staggering, right?! That’s why we’ve turned our focus to getting to know the streaming viewer and understanding who they are on a human level. We want to understand their values, habits, motivations, purchasing preferences, and more. Whether you’re a media company looking to optimize content distribution and attract advertisers, a brand determining ad spend, or an agency looking into creative and advertising for clients, one of your top priorities for 2021 needs to be tapping into the streaming viewer.

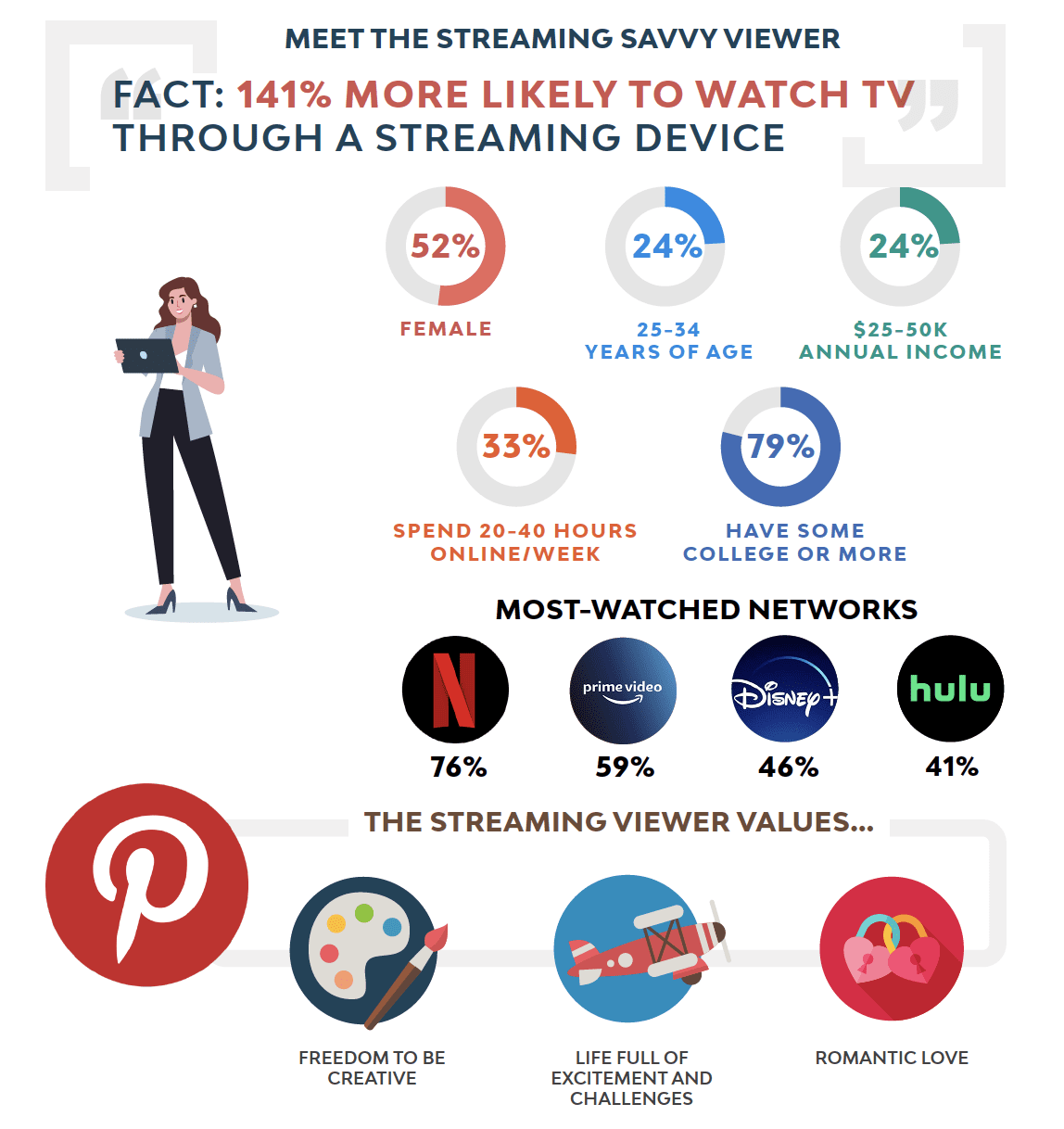

So let’s look a bit deeper at the consumers who have streaming subscriptions — the Streaming Savvy viewer as we refer to them in our State of OTT report.

38% of the Streaming Savvy viewers are millennials, which means they’re 25% more likely to fall into that generation than the average American consumer. They’re almost evenly split male/female and 46% have children under 18 at home. 24% have an annual household income between $25-50K and 55% own their home.

It’s hard to tear them away from the internet — 25% spend more than 40 hours a week online. They’re most likely to use entertainment/lifestyle and photo/video service apps. Where will you find them online? 43% are on Twitter, 83% on Facebook, 52% on Instagram, and 68% on YouTube. Additionally, they’re 18% more likely than the average consumer to share a product or service online.

You’re looking at a group who values creativity and who looks to live a life full of excitement, yet they’re also 15% more likely than the average consumer to value duty and obeying laws — if you have a PSA regarding precautions during the pandemic, this could be a receptive group. They look for products that are fun/exciting, family friendly, and cost-effective and 78% say the best price drives their retailer selection.

Looking at their plans for purchases over the next 12 months, roughly a third plans to purchase items within the following categories: pet supplies, movies, books, and music, bed and bath, computers, tablets and smartphones, garden and outdoor, and toys and games. If you’re an advertiser in one of these areas, you’ve found your people.

Finally, what networks are they watching? Netflix is, by far, their most-watched network, garnering 76% of this group. Additionally, Amazon Prime Video captures 59%, while Disney+ has 46% and Hulu comes in at 41%. When it comes to the OTT devices they’re using: they’re 102% more likely than the average consumer to use Google Chromecast, 98% more likely to use Amazon Fire TV Stick or Roku, and 97% more likely to use Apple TV.

3 insights to connect with the Streaming Savvy viewer

If the Streaming Savvy viewer is on your radar as you finalize 2021 strategy (and they should be!), here are 3 key insights to connect by meeting consumers where they are online and in life.

- Give them something to share on social: Since this group is more likely than the average consumer to share a product or service online, make it easy for them! Create an engaging community on social media where you share made-for-social content. Consider resharing viewers’ posts and they may want to get in on the action. This is the time to trend.

- Don’t write off children’s programming: 46% of this group has children under 18, “family-friendly” is one of their top product preferences, and 46% watch Disney+. While the next binge-worthy hit may not be a kids’ show, that doesn’t mean you shouldn’t consider family-friendly programming in your content distribution if you’re a media and entertainment company or your ad creative if you’re a brand or agency.

- Hit a home run with values-driven messaging: you know that these viewers value creativity and excitement. Additionally, they’re more likely than the average US consumer to list both US and international travel as a top hobby. Whether you’re in content optimization or on the advertiser side, appealing to a sense of wanderlust is going to pique their interest.

Want more insights on the State of Streaming?

Download our 2021 State of OTT today for a deeper dive into the streaming savvy viewer, the pandemic effect, potential cord cutter opportunities, and the sweetheart of streaming in 2020. Then, register for our January 28 webinar, 2021 State of OTT + Actionable Audience Insights. You’ll hear from streaming experts, including Joseph Naylor, Senior Director – Product, Data & Advertising Technologies at Cox Media Group and David Scheur, Senior Brand Manager at Sling TV. Plus, you’ll have the opportunity to ask your own questions during a roundtable discussion. You won’t want to miss this!