Stores Are Beginning to Open. Are Consumers Ready to Shop?

Online shopping, curbside pickup and same-day delivery has been the standard in retail over the past several months. As we tried to decode different messages regarding the spread of COVID-19, assessed our personal willingness to accept varying risk levels and incorporated the use of masks and hand sanitizer into our everyday lives, it often just seemed easier to click, “add to cart” from the comfort and safety of our own homes.

But, with social distancing measures in place across the country and phased reopening moving along, many shoppers are ready to browse in-store again. For those consumers, they’re dreaming of a leisurely stroll through the grocery store picking up ingredients on a whim. They’re missing the siren call of that red Target symbol (seriously, who else is ready to find themselves lost in aisles of Magnolia home goods we didn’t realize we needed?!). They’re ready to pick up a product and feel it in their hands before deciding to buy.

Let’s Look at the Types of Stores Where Consumers Will Go First

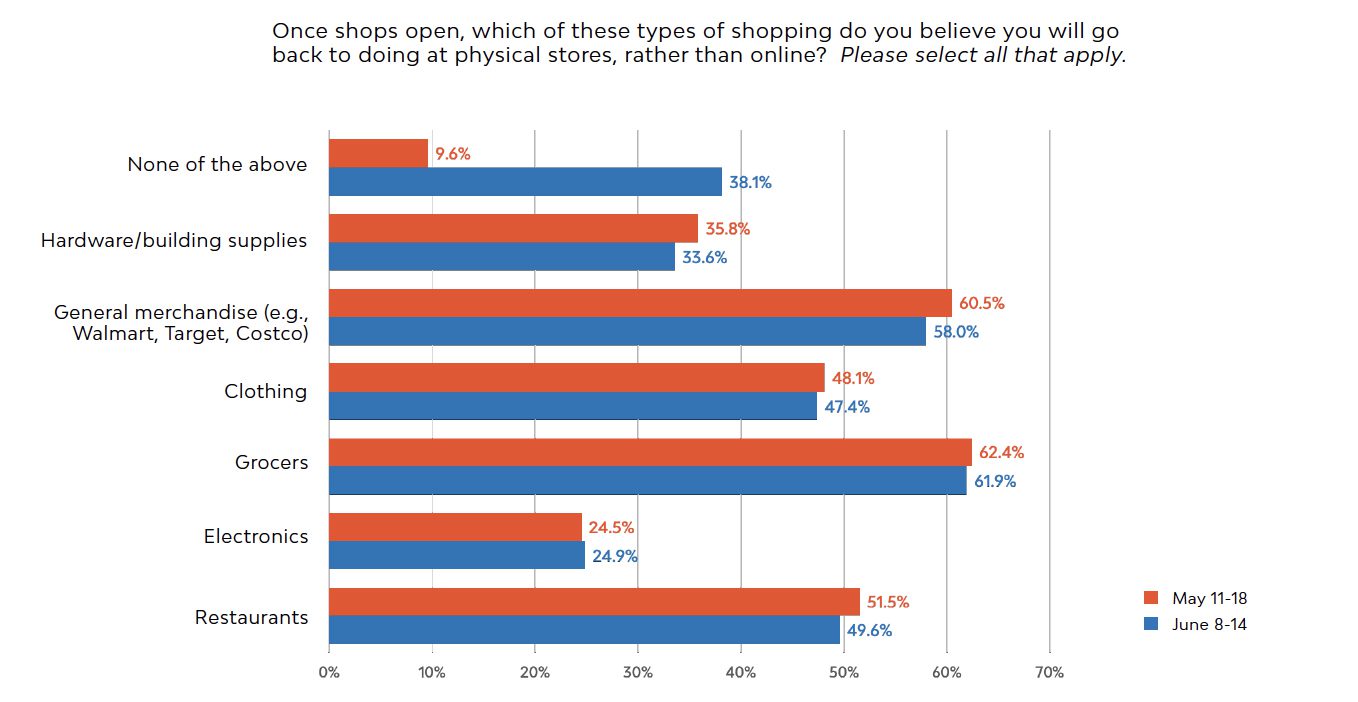

We surveyed consumers to see exactly where they plan to shop in-person again once stores have reopened. It’s likely not surprising that the largest groups are eager to get back to grocery stores and general merchandise stores (Walmart, Target, Costco, etc). Consumers need the basics and it can be more convenient to stop by the store and grab toilet paper or milk when you need it, rather than order it online and have it shipped.

The next group is a bit more surprising: clothing. Many of us may assume that most people do their clothing shopping online with easy returns available through most stores. But, almost half of consumers are ready to shop ‘til they drop –– or at least pick up a few summer pieces for the sweltering weather.

Another 34% are ready to shop for hardware/building supplies in person. We know that many consumers were excited to redecorate and create an oasis in their own home, so these consumers will be ready to head back into stores and pick up what they need for projects.

Lastly, 25% are going to shop for electronics in person. Perhaps they want to test out a new phone in person or browse available televisions.

Who Are These In-Store Shoppers?

So, who are these shoppers that are eager to go back in-store to shop? Here are a few key facts about the shoppers we see in each vertical.

GROCERY SHOPPERS: This group is 53% female, 19% are between 45 and 54 years of age, 16% have a household income between $100-150K and they’re more likely than the average consumer to shop at Trader Joe’s. They have an optimistic outlook and value safety in their community and nation. While they’re ready to go back in-store, their values would indicate they’re willing to take all precautions to ensure the safety of both themselves and those around them.

This group is more likely to buy food based on nutrition and to limit calories/fats/salts, so they’re probably eager to shop for fresh foods in-person and on a regular basis again.

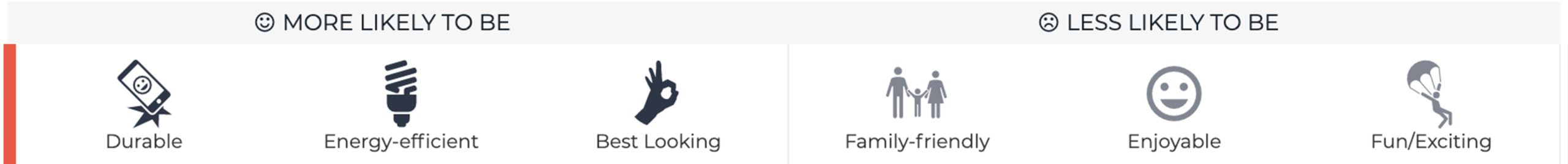

When it comes to product selection, they look for products that are:

GENERAL MERCHANDISE SHOPPERS: The shoppers who are ready to return to big-box stores such as Walmart and Target are 53% female, 19% are between 35 and 44 years of age, 21% have a household income between $50-75K and they’re more likely to shop at Costco. They enjoy gardening and buy food based on nutrition, so they look to shop somewhere where they can knock out all items in one trip.

This group wants to show their abilities and be admired, as well as maintain a good public image, so they’re likely to act in line with what they perceive to be the socially acceptable behavior –– wearing a mask and staying six feet away from other shoppers.

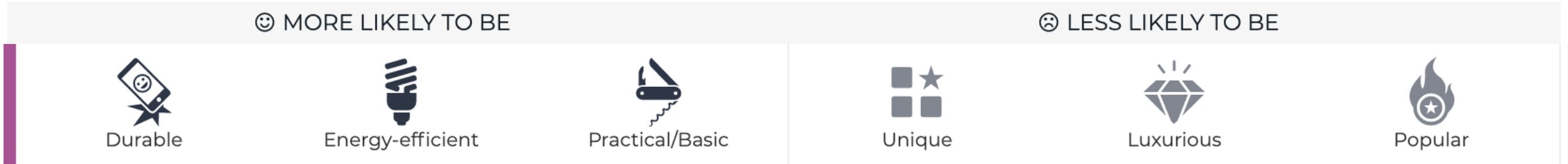

When it comes to product selection, they look for products that are:

HARDWARE SHOPPERS: These DIY-ready shoppers are 52% male, 17% are 65+ years of age, 17% have a household income between $100-150K, and, fittingly, they’re most likely to shop at Ace, Lowe’s and Home Depot. They have an optimistic outlook, value safety in community and nation, maintaining traditions and being reliable and trustworthy.

This group is 22% more likely to list home improvement as one of their top hobbies and 19% more likely to list gardening. Given their desire for safety in community, remember to disclose all precautions being taken to make them feel comfortable stepping foot back in your store.

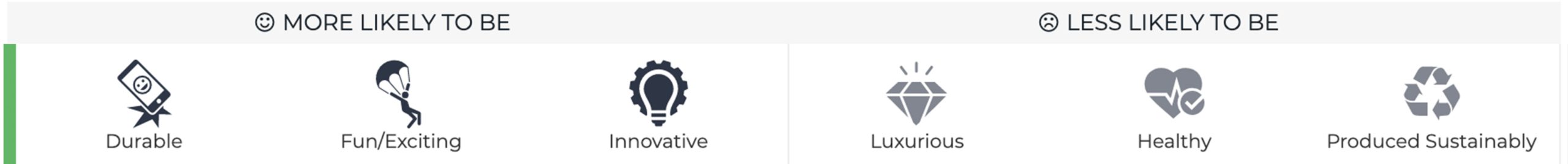

When it comes to product selection, they look for products that are:

ELECTRONICS SHOPPERS: This group is 53% male, skews younger with 14% between 18-24 years of age, 28% have a household income between $25-50K and they are most likely to shop at Best Buy, Sam’s Club and Costco. Don’t underestimate the likelihood that they could buy their electronics from a big box store!

Their top hobbies include going to the movies, playing video games and watching sports on TV. Since the movie theaters may be among the last institutions to open in some states, consider how you can market products that will bring that experience into their own home.

When it comes to product selection, they look for products that are:

CLOTHING SHOPPERS: These clothes horses are 51% male, 14% are between 18-24 years of age, 26% have a household income between 18-24 years of age and they’re most likely to shop at Costco, Kohl’s, Clark’s or Athleta. Exercise and athletic accomplishments are important to them, which may mean they’re looking to Athleta for the athletic clothes they need.

They value showing abilities and being admired, as well as maintaining a good public image, while they’re driven by proving competence and earning respect from others. It could be likely, given their age, that they’re early in their career/adulthood and need to buy the clothes that are representative of their new place in life.

When it comes to product selection, they look for products that are:

Once Stores Are Open, What Do Shoppers Expect to Feel Safe?

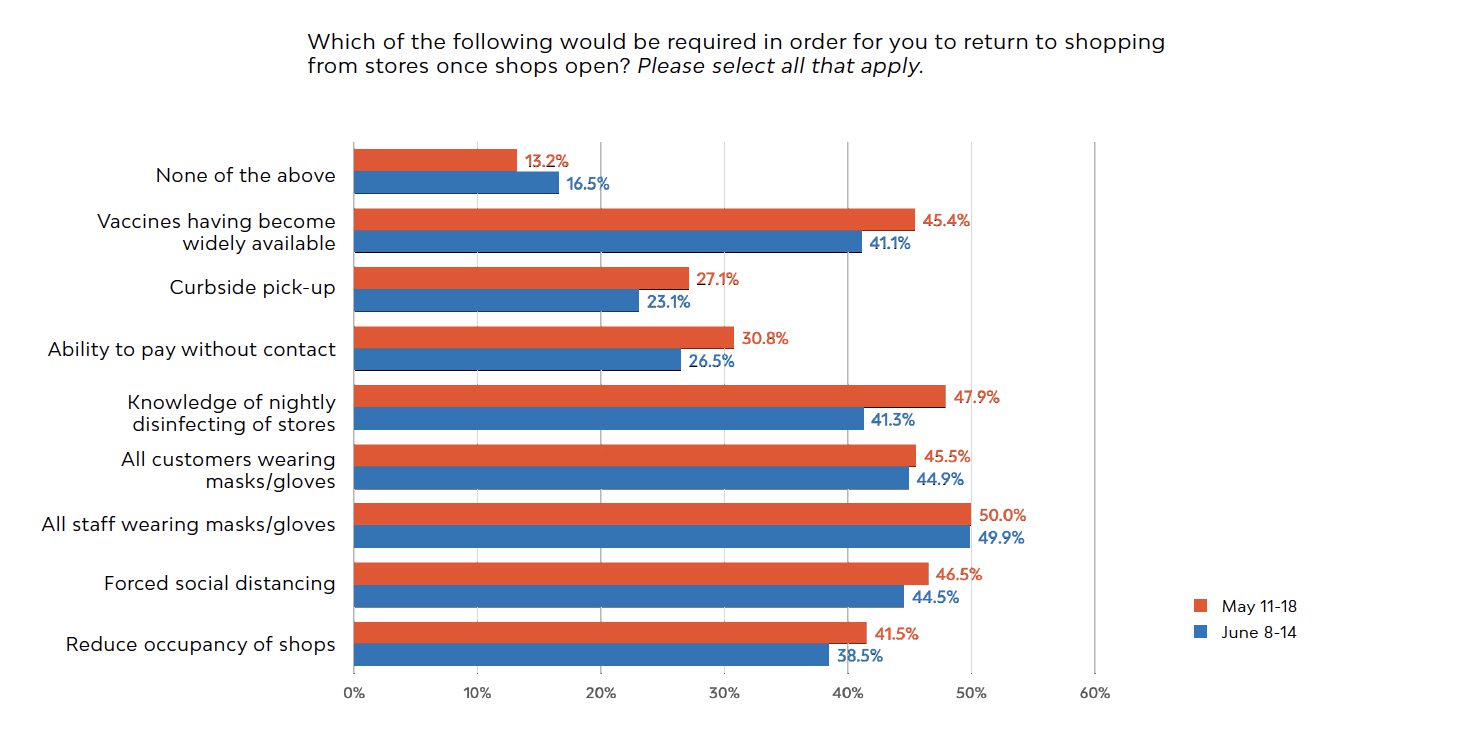

If you want eager-to-shop customers to feel comfortable coming back through your doors, what do you need to do? Half of consumers believe all staff should wear masks/gloves, while 45% expect the same from all customers. Others expect nightly cleaning, forced social distancing and reduced occupancy of shops. However, despite all those eager to get back into stores, roughly 40% say they won’t return to stores until a vaccine is widely available.

Learn How to Market to Your Target Customers Today

Want to learn more about where consumer sentiment stands today? As a retailer, your first two stops should be our Wave 4 report of data on consumers during the coronavirus pandemic, Marketing in the New Normal: Critical Data You Need Now, and our report on consumer readiness to reopen, From Rushed to Resistant: How Eager Are Consumers to Reopen America? And, if you’d like to dive further into a specific segment, contact us to request a demo today.