We’re seeing drastic shifts across verticals in the wake of the coronavirus pandemic. But, consumer and packaged goods are seeing increased demand as customers stock up on groceries, alcohol and more.

In this post, we’re going to look into two specific CPG groups: those who are increasing online grocery delivery and those increasing the frequency of drinking at home.

Customers are Stocking Their [Online] Grocery Carts

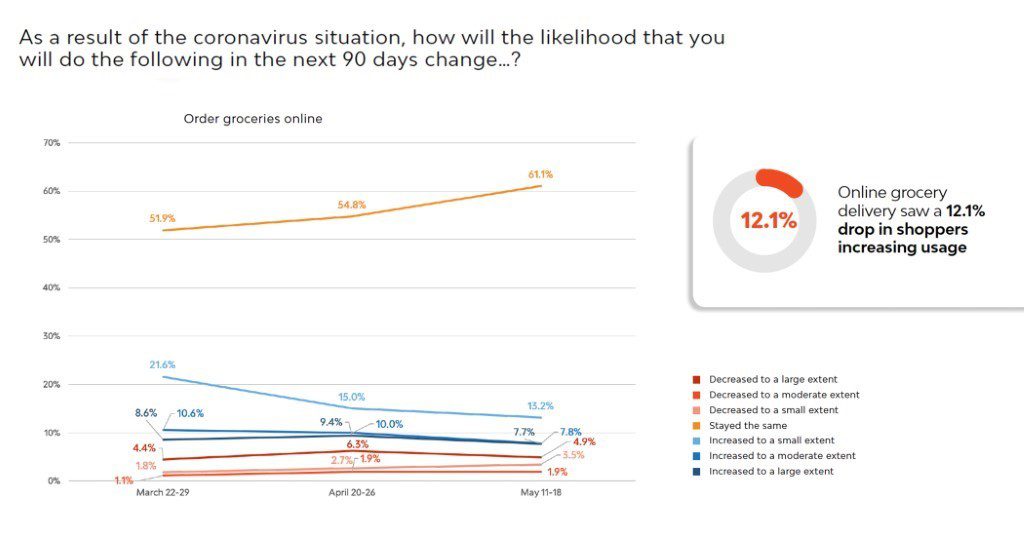

In our latest report on the impact of COVID-19 on consumers, we continue to follow trends in consumer behavior, including the likelihood that shoppers will turn to ordering their groceries online. In our Wave 3 report, we did see a 12.1% drop in consumers increasing their use of online grocery delivery services (perhaps in part due to the difficulty getting a time slot this spring?). However, we’re still looking at a group of 42 million Americans when it comes to those continuing to increase online grocery delivery.

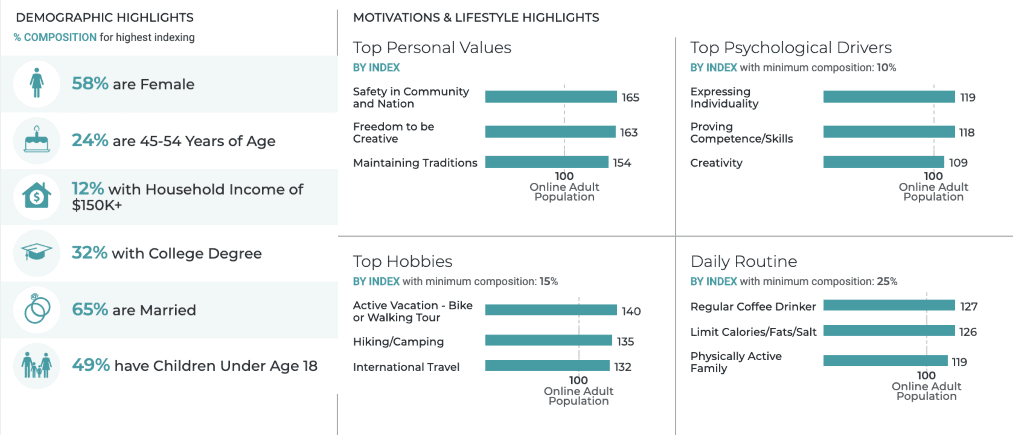

Who are the consumers that are continuing to increase their online grocery delivery orders? 58% of them are female, 24% are between 45-54 years of age and roughly half have children under 18. Additionally, they value safety in their communities –– which explains their commitment to ordering groceries online rather than crowding grocery stores.

And, how do these online grocery shoppers relate to CPG purchases? Well, they are 26% more likely than the average U.S. consumer to buy meal replacement bars and 204% more likely to use Nespresso pods at home. Both of these numbers align with their daily habits: this group is 26% more likely to limit calories/fats/salts and 27% more likely to be a daily coffee drinker.

75% of these online grocery shoppers are buying salty snacks, while 63% are buying cookies or crackers. If you’re shopping for groceries online, you’re likely looking for shelf-stable items that will survive the shipping and delivery process and we see this in their buying preferences.

46% want products that are dependable, 49% are looking for cost-effective options and 55% want high-quality products. These could be your shoppers looking to legacy brands during this time. 68% shop at mass merchants, while 28% have shopped at Kroger in the last 6 months and Aldi in the last 3 months.

But, how should brands make sure they’re the snack brand that shoppers turn to as they increase their purchases of shelf-stable packaged goods? Lays hit a home run by appealing to all the core values of this audience: safety in community and nation with a socially distanced campaign, freedom to be creative with the idea of being a #JoyGiver, and maintaining tradition by emphasizing a focus on a sense of togetherness.

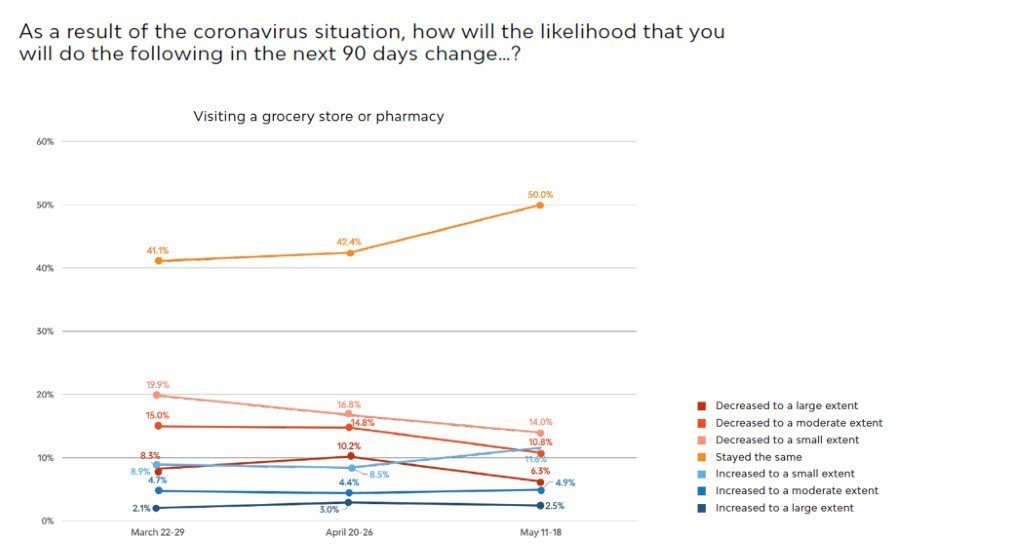

Of course, eventually shoppers may go back to stores and we do see that consumers indicating they do not plan to visit a grocery store or pharmacy in the next 90 days has decreased from March to May.

At-Home Bartenders are Raising a Glass

Now, let’s look at the 17.2 million people whose consumption of alcohol at home has increased. While many of us may have reserved a weekend cocktail for a night out, it seems mastering the art of the Old Fashioned has become as essential to staying at home as baking sourdough bread.

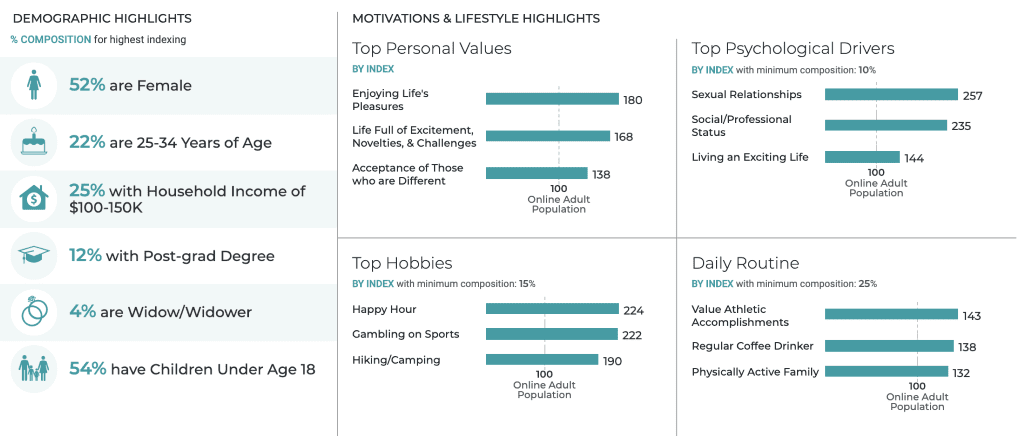

Who are these cheers-ing consumers? This group is 52% female and younger than the grocery shoppers at 25-34 years of age. 25% have a household income of $100-150K. They are 80% more likely to enjoy life’s pleasures and 68% more likely to crave a life full of excitement. And, no surprise, they are 124% more likely to say happy hour is one of their top hobbies.

What about their alcohol preferences? When it comes to beer, they’re 99% more likely to care about variety, 45% more likely to care about price and 35% more likely to care about bottle v. can. So, if you’re marketing to this group, you may want to emphasize the options available –– or even create a system to build your own 6 or 12-pack of bottles. Give them access to both variety and budget-friendly options.

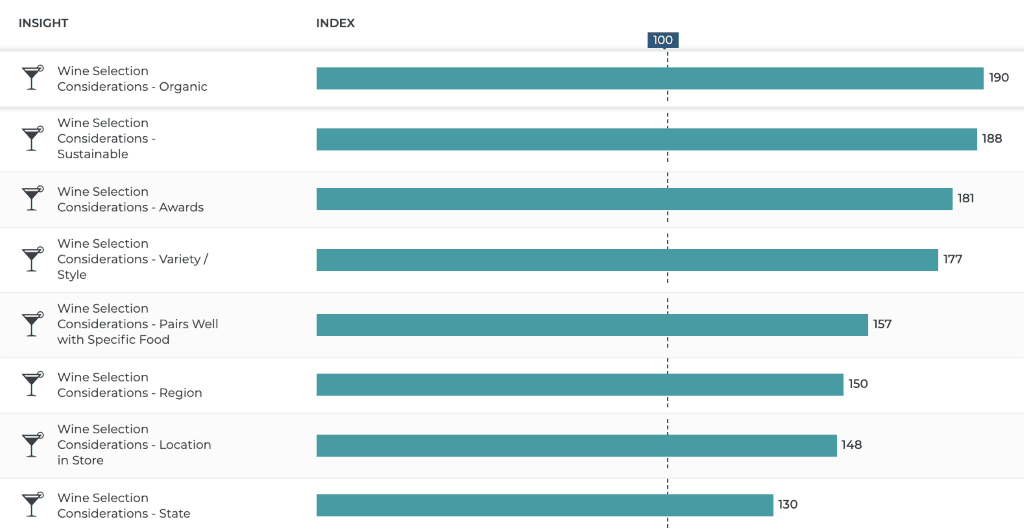

If it’s a wine night, this group is 40% more likely to sip on a fruity wine and 37% more likely to appreciate a tannic varietal. They’re also 39% more likely to look for a wine under $10 (hey, it needs to be budget friendly during quarantine!).

When it comes to liquor, they’re 50% more likely to choose a brand based on a personal recommendation, but they’re also 44% more likely to be lured in by a fancy bottle design. They’re 29% more likely to be brand loyal, but 28% more willing to try new drinks.

This group overall, regardless of alcohol type, is 27% more likely to buy based on advertising. So, if you’re looking to target a group with your latest ad campaign –– this is it. And, if you’re wondering where to find them: they’re 69% more likely to be engaged on both Instagram and Twitter, while they’re 50% more likely to be engaged on Pinterest. Which means you should pay attention numbers released in April indicating social media engagement for alcohol brands was 327% higher this spring. There’s an intersection and opportunity to be found with this group, alcohol advertising, and social media.

Image via Adweek

CPG Sales Will Return to Stores Someday Soon…

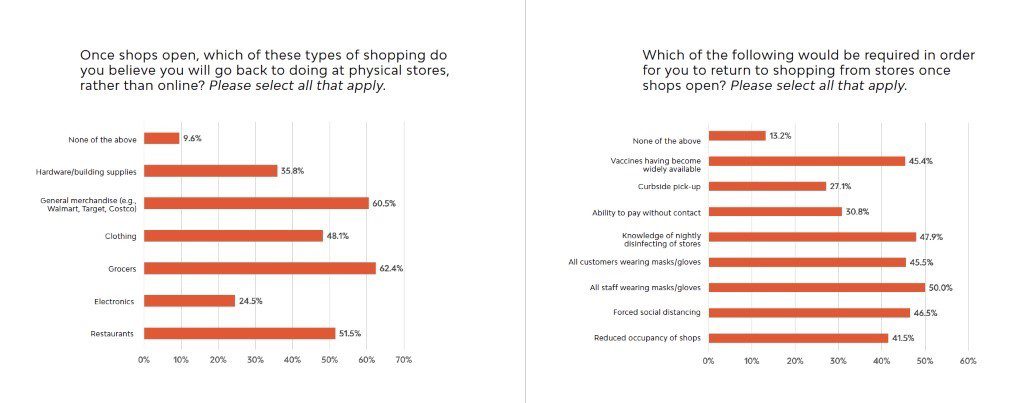

With most states reopening, we know that many of these consumers plan to return to shopping in-store rather than online. So, we wanted to leave you on a high note here: 60.5% of consumers are eager to return to general merchandise stores once they reopen –– that includes Walmart, Target, Costco, etc. Additionally, 62.4% plan on returning to grocery stores. Though, this should come as no surprise given that Target’s average day for online sales during April was bigger than Cyber Monday.

Want to get them through doors sooner rather than later? Look to place your products in stores that are mandating staff wear masks/gloves and are forcing social distancing.

If you’re looking to learn more about how consumer preferences are evolving –– and will continue to evolve -– in the coming weeks and months, remember to register for our CPG webinar on June 25, Toilet Paper to Tequila: Tracking CPG Consumption as America Reopens, and, in the meantime, download our latest report on consumers and COVID-19: Reopening America: Up-to-the-Moment Consumer Sentiment During the Pandemic.