We’re entering a new year, and cord-cutters have yet to kill cable. TV advertisers, however, face new challenges from the pandemic-driven streaming boom to the phasing out of 3rd party cookies. Media companies know that the allure of OTT alone won’t convince advertisers to sign on the dotted line; they’ll need to prove their unique value. And to them, nothing is more valuable than the people sitting on the other side of the screen.

Let’s take the recently buzzed-about Paramount+ and its premium cable counterpart (but also standalone subscription service), Paramount Network.

Peeking at both Paramount Network and Paramount+ subscribers inside the Resonate Ignite Platform™, uncovered a world of opportunity for the media company to secure big advertising dollars in two key markets: sports and politics. Let’s discuss.

But first, let’s talk about sports advertising…

With the Winter Oly****s happening in February and the FIFA World Cup starting in late November, we can expect a VERY interesting year in sports and sports advertising—especially given the rise in streaming wars for sports content. To name a few examples:

- NBCUniversal is shutting down NBC Sports Network and betting on Peacock for sports

- The new official Thursday Night Football is set to be streamed on Amazon’s Prime Video

- Viacom is moving Inside the NFL from Showtime to Paramount+

Having both network and streaming audiences can mean big ad revenue for CBS Entertainment Group.

Where do Paramount audiences fit into the picture?

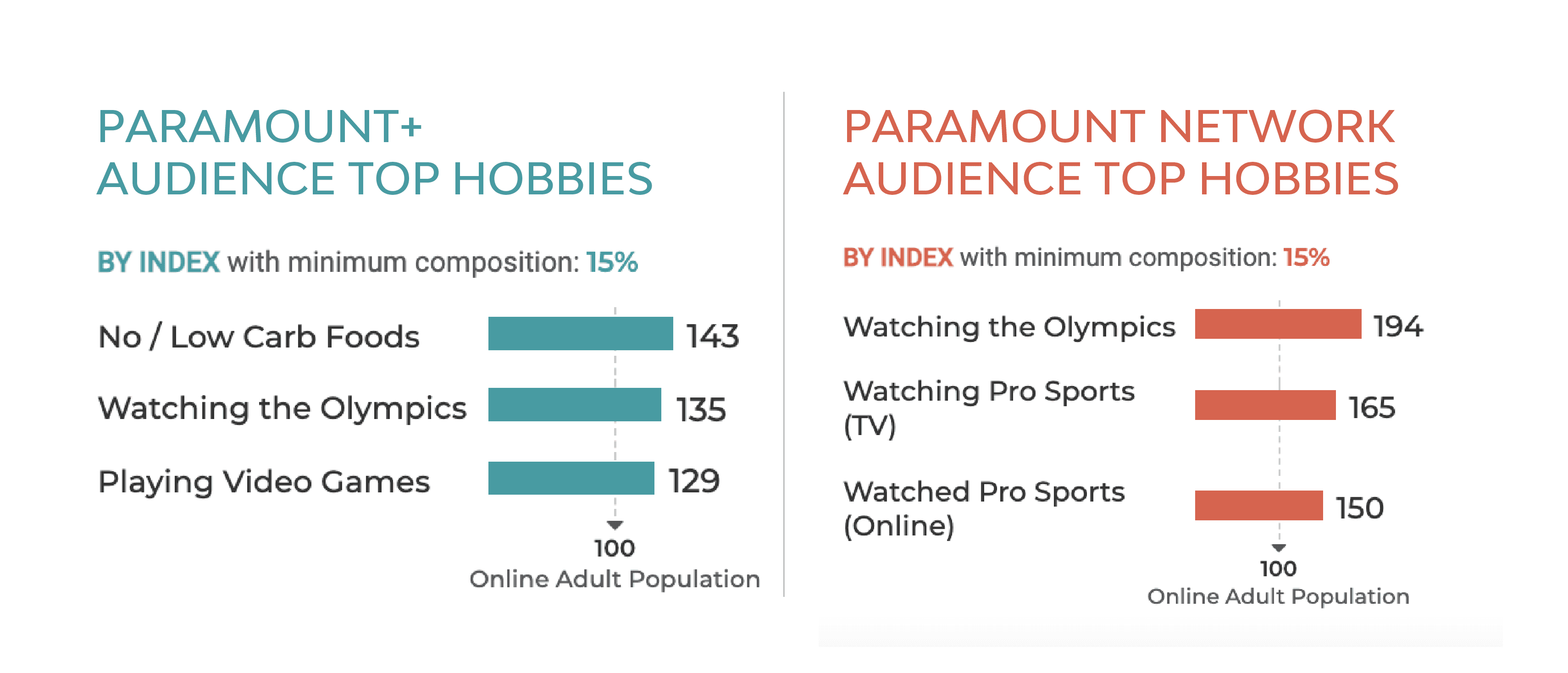

Teal: Paramount+ Subscribers, Red: Paramount Network Watchers

Source: Resonate Ignite Platform, December 6, 2021.

An easy-to-spot observation is that both audiences are more likely to watch the Olympics than the average US consumer. But, while Paramount+ subscribers are 35% more likely to watch, Paramount Network watchers are a whopping 94% more likely to watch the event.

An even closer look at these audiences shows just how much more prone Paramount Network subscribers are to watch sports in general, be it on TV or online. It makes up 3 of their top 3 hobbies!

What this means for media:

The media company doesn’t have to lose out on advertising deals to and with other providers, like ESPN and Fox Sports, just because its non-streaming audience doesn’t watch sports. That’s definitely a good thing given CBS Entertainment Group’s desire to change that.

“Paramount Plus will be the leader in live sports,” CBS Entertainment Group head George Cheeks said bluntly. “Bottom line, everything sports fans love on CBS . . . all of this will be available on Paramount Plus.” (Source: Deadline, 2021)

The key is learning how to reach these audiences and where to reach them to increase ad revenue and optimize yield management. While Viacom continues making money moves to turn Paramount Plus into a booming sports destination, the network can keep securing advertising dollars because its audience is full of sports fans today!

Switching gears—let’s talk politics…

Okay, I know I said it would be an exciting year for sports but what happens in the political ad space is sure to be next year’s blockbuster.

With a nearing cookie-less future, political campaigns are set to change dramatically, and midterm elections are coming up. While we saw the start of political CTV ads in the last big election cycle, the pandemic accelerated the growth of streaming and ad tech. According to Axios, we can expect that digital TV ads will flood living rooms during the 2022 midterms.

Where do Paramount audiences fit into the picture?

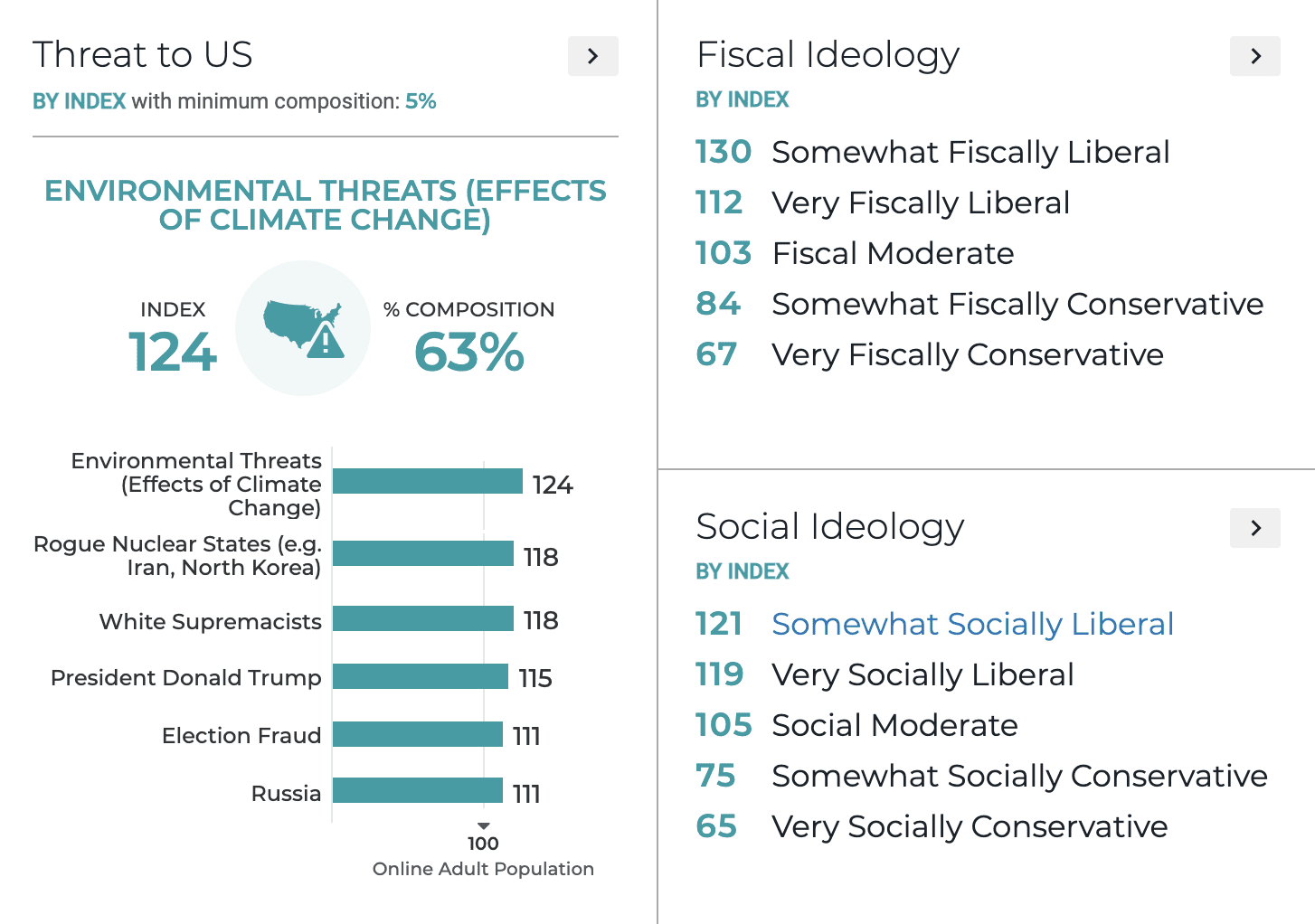

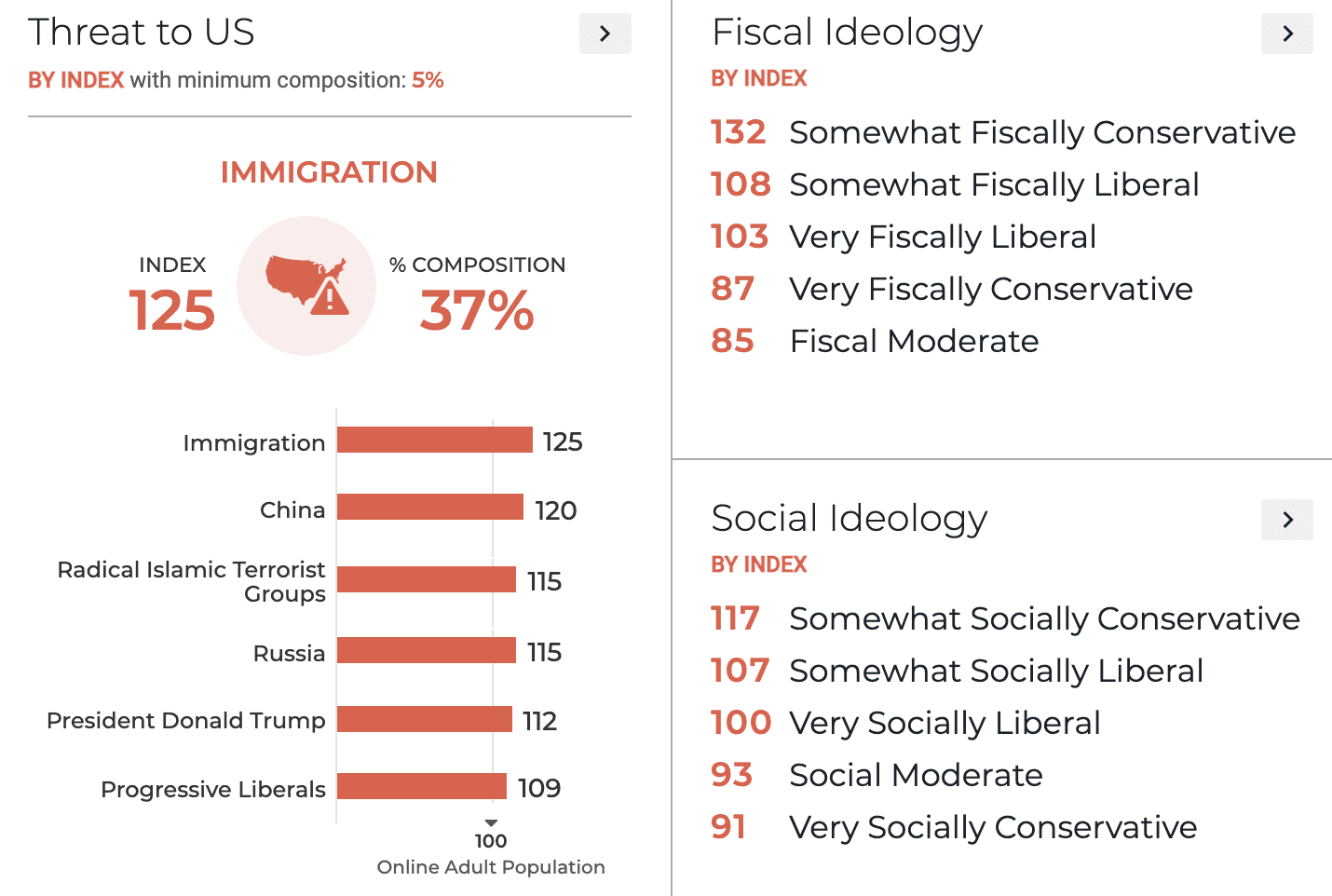

Teal: Paramount+ Subscribers, Red: Paramount Network Watchers

Source: Resonate Ignite Platform, December 6, 2021.

At first blush, you’d think network watchers and streaming subscribers aren’t that different; around 40% of both audiences are registered Democrats. But, here’s where human-level insights come into play and nuance matters most: they differ in everything from voting frequency to fiscal ideologies to their most pressing social issues.

While Paramount+ subscribers skew on the more liberal side of the spectrum, Paramount Network viewers are more conservative, both socially and fiscally.

What this means for media:

With the impending death of cookies and the inevitable rise of CTV campaigns, the odds favor the media company with the insights to inform a great political strategy. To win these hunger games, CBS Entertainment Group can use deep consumer data to show—not just tell—advertisers that they have a candidate’s audience, where to reach them, and what political drivers should be considered for messaging.