When do consumers see the world returning to normal? How has their stance changed politically in this changing climate? Are they comfortable thinking about spending money this holiday season? Resonate continues to track real-time data on what Americans are thinking, doing, and buying in our Resonate COVID-19 and Emerging Trends Report, Wave 20, October 2021. Today, we’re sharing a sneak peek into what’s changed in the past few months, so you can stop guessing while you plan for 2022.

About the report: Resonate’s proprietary Coronavirus and current events data is released monthly and connected to our core data set with thousands of critical consumer data points. This latest Recent Events Connected Flash Study was fielded between September 13 and September 27, 2021, and is scaled to 230 million U.S. consumers.

1. Consumers are actually more anxious about the economy now than before

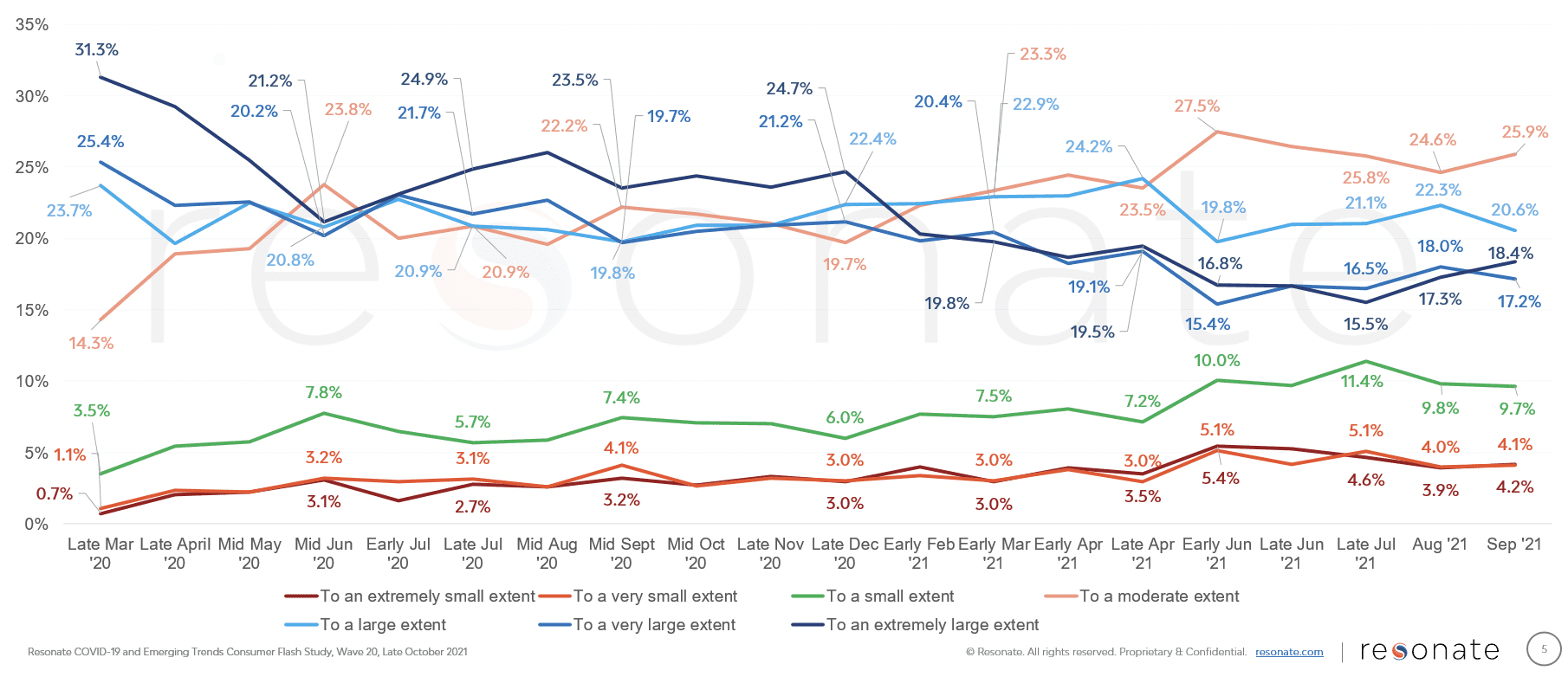

Remember the promise of Hot Vax Summer? The world was ready for the collective release of pent-up energy and demand for travel, dining, and the overall good life. Then, the Delta variant happened, and many Americans, including those vaccinated, had to accept that they’d continue to face uncertainty when it came to their safety. The emotional fatigue of the ongoing pandemic is palpable. Extreme consumer anxiety about the economic-related consequences of the Coronavirus is up a whopping 19% from the summer months.

Overall, to what extent are you concerned about the economic-related consequences of the coronavirus situation?

What this means: Unlike last year, we are not creating a COVID-19 response in a vacuum. Update what you already have, reflect on the past mistakes and missteps of others, and craft a message that reflects the times as they stand now. Pandemic messaging shouldn’t look like it did in 2020. If you know consumers are burnt out from hearing about Coronavirus, consider how you can create more balanced, aspirational marketing messages while still keeping it real about the pandemic. More importantly, gauge what your consumers truly need and want (HINT: It’s in the report).

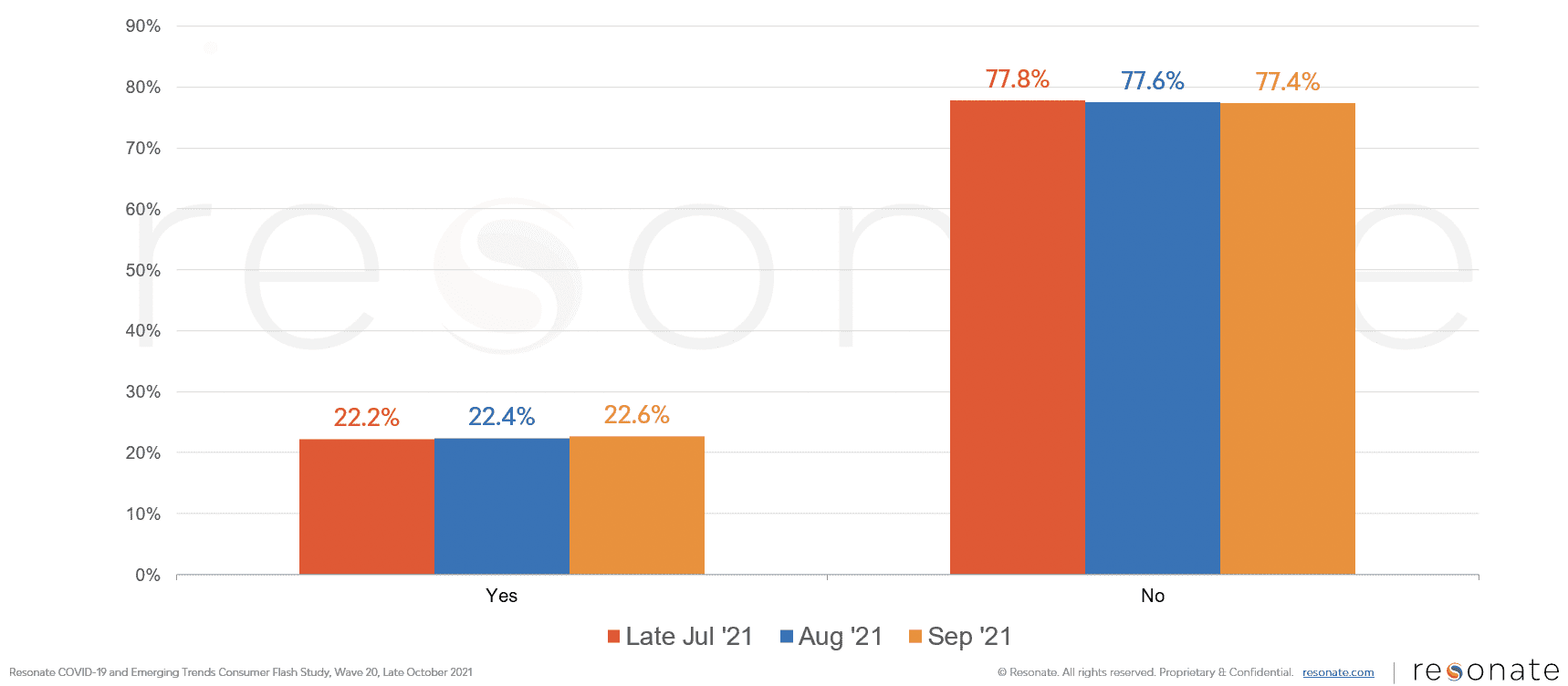

2. Despite Point 1, Most People are Still Ready to Hit the Road

Good news for the travel industry: travel plans have not wavered. 3 in 4 U.S. consumers are ready to pack their bags and hit the road (or skies), with relatively little change from summer. Whether it’s due to personal health concerns, travel restrictions, or anything in between, vaccines have been central to the return of travel — and many Americans are getting vaxxed. According to the CDC, nearly 80% of Americans over the age of 18 had received at least one dose of the vaccine as of November 1, 2021.

As a result of the coronavirus situation, have you initiated the cancellation of an existing airline or hotel reservation?

What this means: The return of travel does not mean it’s ‘back to business as usual’. In fact, our recent studies show there are widely differing attitudes and timelines on returning to travel. When we look at the differences between an eager traveler and a cautious one, crafting the right message (on the proper channels) is crucial. Messages of excitement and adventure will resonate with eager travelers, while flexibility and staycation travel messaging will be key for cautious travelers.

What this means: The return of travel does not mean it’s ‘back to business as usual’. In fact, our recent studies show there are widely differing attitudes and timelines on returning to travel. When we look at the differences between an eager traveler and a cautious one, crafting the right message (on the proper channels) is crucial. Messages of excitement and adventure will resonate with eager travelers, while flexibility and staycation travel messaging will be key for cautious travelers.

Additionally, focus on putting the precautions into place that will reassure and encourage your travelers. Curious what travelers actually care about seeing throughout a hotel stay or flight? Download our Travel and Hospitality Marketer’s Playbook.

3. Even More Americans See a Longer Road to Recovery

Over a year and a half into the pandemic, most Americans don’t expect life to return to what it was for some time. 82% expect the economy will return to normal (whatever that means anymore!) in seven months or more. Viral variants, talks of booster shots, and a slower-than-planned vaccination rate are just a few of the possible reasons even more consumers see a longer road to recovery than before.

When do you believe the United States economy will return to “normal,” as it was before the coronavirus situation began?

What this means: The collective mindset of most Americans is that we’re in this for the long haul. Marketers, whether you’re crafting your next holiday campaign or planning for Q1 2022, it’s crucial you keep this particular consumer signal in mind. After a disappointing summer that crushed many dreams of going back to normal, consumers will be more intentional with their spending. Your job will be to ease and inspire with every message.

Lessons on Adapting Quickly to Changing Consumer Behavior

At Resonate, we’re constantly fascinated by consumer trends. Our ongoing Wave Reports, and this latest one specifically, show just how much COVID-19 has affected their values, motivations, and preferences— thus transforming their buying behavior. As marketers, advertisers, and communicators, we can only impact and adapt to what we can see. When we observe, listen to, and understand those changes in behavior, we can craft messages and experiences that resonate with our audiences. That will make all the difference in the uncertainty that lies ahead.

—

Did you find these consumer trends interesting? You haven’t seen anything yet!

For the latest data revealing where consumers stand today and how to connect with them now, download the full report: Resonate COVID-19 and Emerging Trends Report, Wave 20, October 2021.

![[Sneak Peek] Wave 20 Shows How Current Events Impact Consumer Habits](https://www.resonate.com/wp-content/uploads/Wave-20-Blog.png)