Turbulent markets, global political shifts, the growth of robo-investing and rising customer expectations have brought a new level of customer churn to wealth management marketers. Resonate’s most updated insights reveal that 24 million U.S. adults are actively considering switching investment firms in the next 12 months.

It’s vital that marketers for investment firms know how many of their own customers and their competitors’ customers plan to make a move and what they’re looking for in their next investment firm. Resonate’s deep consumer insights also reveal:

- Which firms are at the greatest risk of losing customers

- Top selection criteria for people looking to switch

- Consumers’ views about the market and alternative investments

- How to steal your competitors’ customers and retain your own

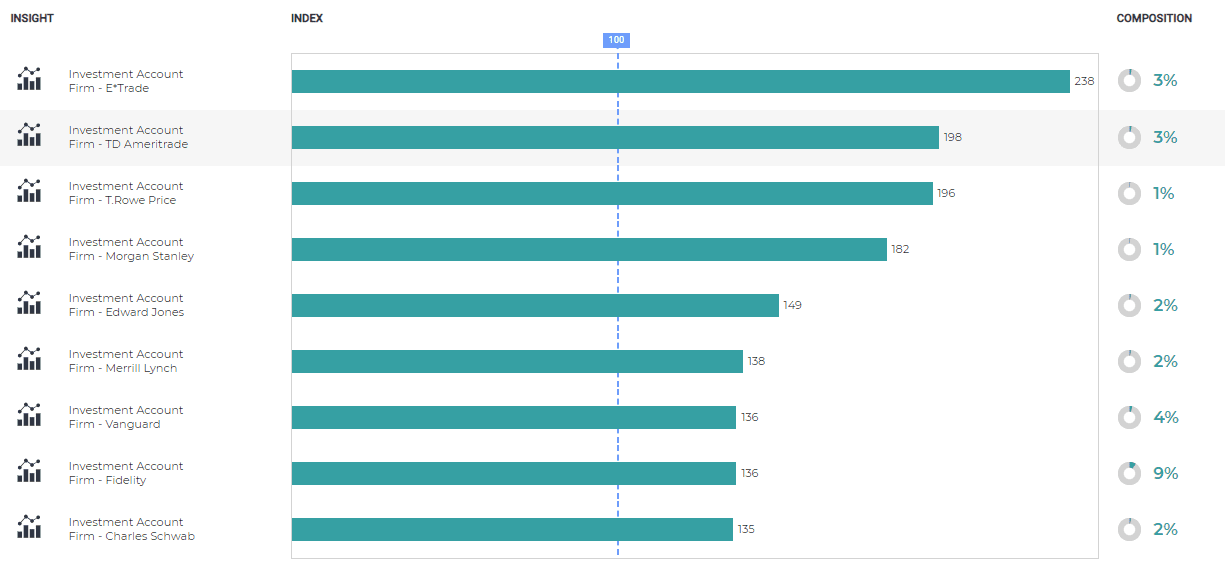

Which Firms Are at Greatest Risk for Losing Customers?

Most investment firms face a retention problem, including some of the biggest brands. Consumers who plan to switch investment firms have accounts with the following firms:

What Do People Want from their Investment Firm?

When it comes to their relationship with their financial advisor, most switchers want great customer service and objective advisors who understand their risk tolerance. But the top selection driver is that switchers want the ability to trade on margins. Firms using Resonate can dig deeper to understand the specific factors most important to their own switchers and segment their competitors’ switchers by brand to tailor messages accordingly.

How Do Consumers Feel About the Market?

Most switchers are on the fence about whether a stock market drop or financial crisis is imminent, but most switchers have a more optimistic view of the future. Marketers should connect with switchers using sunnier messages vs. an approach that speaks to investor fears.

How Do Consumers Feel About Robo-Investing and Cryptocurrency?

Cryptocurrency investing won’t appeal to most switchers, but robo-investing will. Resonate helps you isolate and target the smaller group considering cryptocurrency in their portfolio, while also creating a robo-investing segment for research, segmentation, activation and measurement.

Where Can I Find Consumers Looking to Switch?

Insights on their media consumption also shape your strategy for reaching these consumers, from the top TV shows they’re watching to their top social media networks.

Resonate also has actionable insights on individual investment firms and the who, what, when, where and why of their switchers.

The challenge for wealth management marketers is turning massive amounts of data into insights that allow them to decide on the right strategy for reducing churn. With person-centric insights, marketers can take action to reduce churn in one, easy-to-use platform that’s updated nightly. So, while you can’t just ask, you can find out and act before you lose customers.

Want to see Resonate’s consumer insights in action? We’d be happy to show you more in a demo.