With More Consumers at Home, Streaming TV Eyes an Opportunity

If you’re sitting at home, there’s a decent chance you’ve flipped on the TV. Sure, you’ve been perfecting your focaccia recipe, maybe needlepointing on occasion and, of course, trying to come up with a reason to avoid your next Zoom happy hour. But, between all those time-consuming activities, the siren call of endless streaming programs has been calling your name.

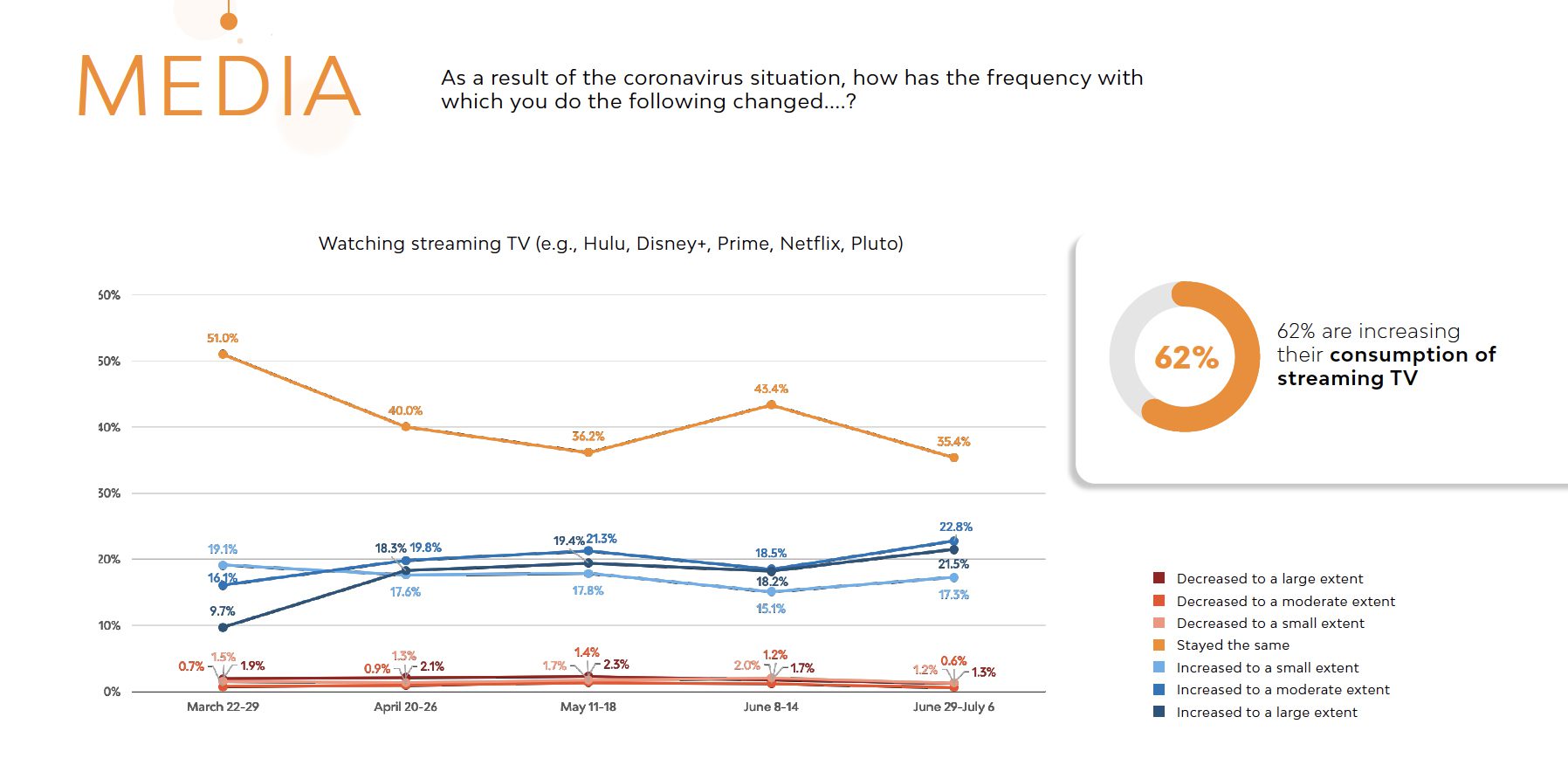

In our wave reports, including the latest, Ready for What’s Next: Insights to Guide You Through the Next Consumer Evolution, we’ve seen a steady group since March 2020 of consumers who say that their frequency of watching streaming TV has increased during the pandemic but, in July, we saw a uptick. 62% of consumers are now increasing their consumption of streaming TV. Compare that to only 3% that are decreasing their viewership.

For context, 39% are increasing their consumption of cable TV.

For streaming channels, that presents a massive opportunity. Now is the time to bring in new viewers and building lasting relationships that will continue even after we enter into a new normal.

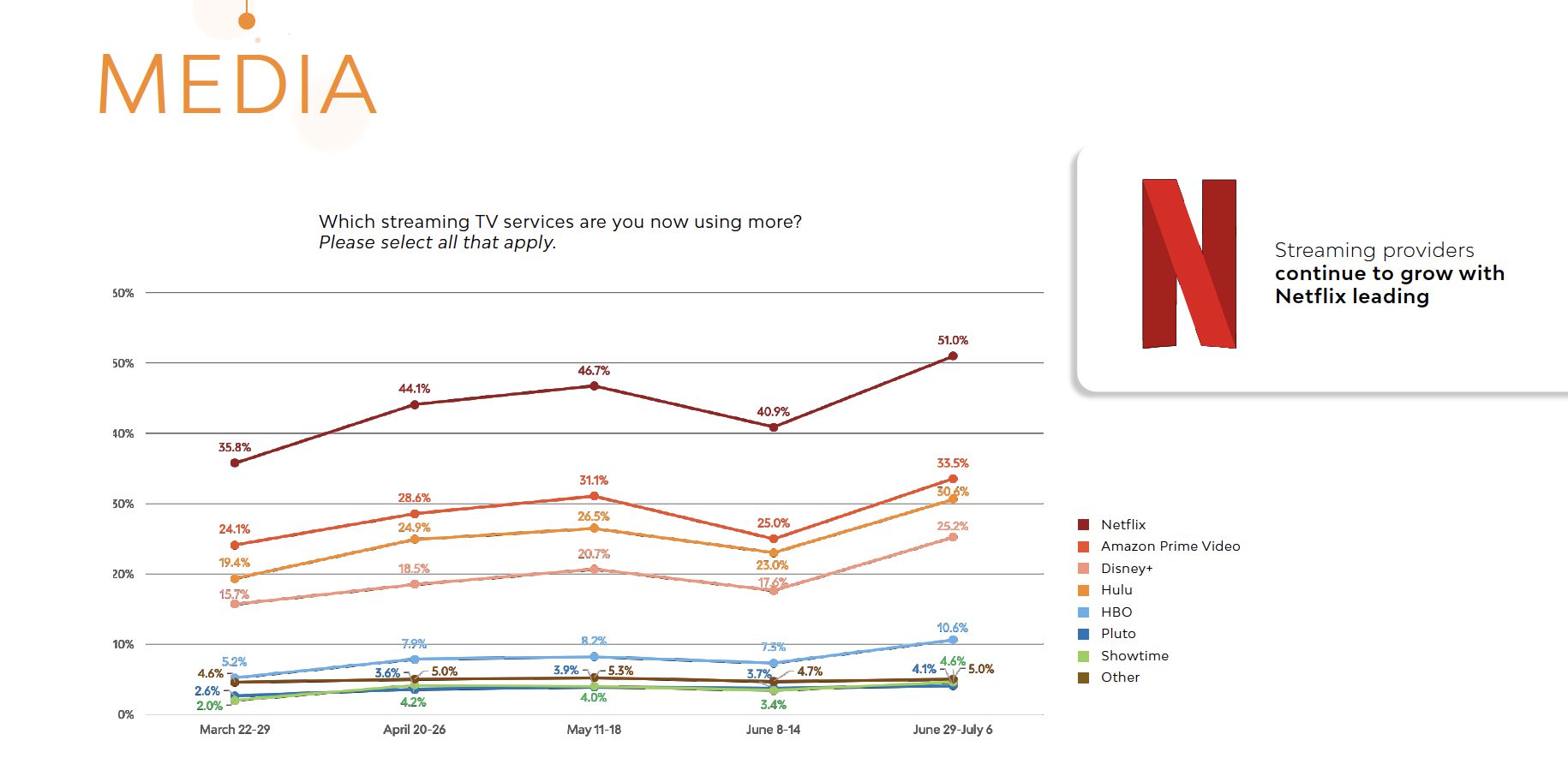

Which channels are dominating the streaming TV landscape? Netflix is growing steadily and rapidly, with 51% of consumers indicating that they are now watching the channel more than they were prior to the pandemic, compared to only 36% back in March.

Netflix knew they had an opportunity and perhaps a responsibility to do their part to encourage people to stay home and it paid off –– and they tripled their digital ad spend during the early months of the pandemic to do so. They ran an ad campaign threatening to spoil their most popular shows with billboards placed in major U.S. cities announcing critical turning points in series (spoiler: the billboard were fake, but the campaign worked). Plus, who could turn away from Tiger King and Love is Blind?!

Other channels seeing an increase include Amazon Prime Video, Disney+, Hulu and HBO, with other channels, including Pluto, Showtime, and HBO remaining constant.

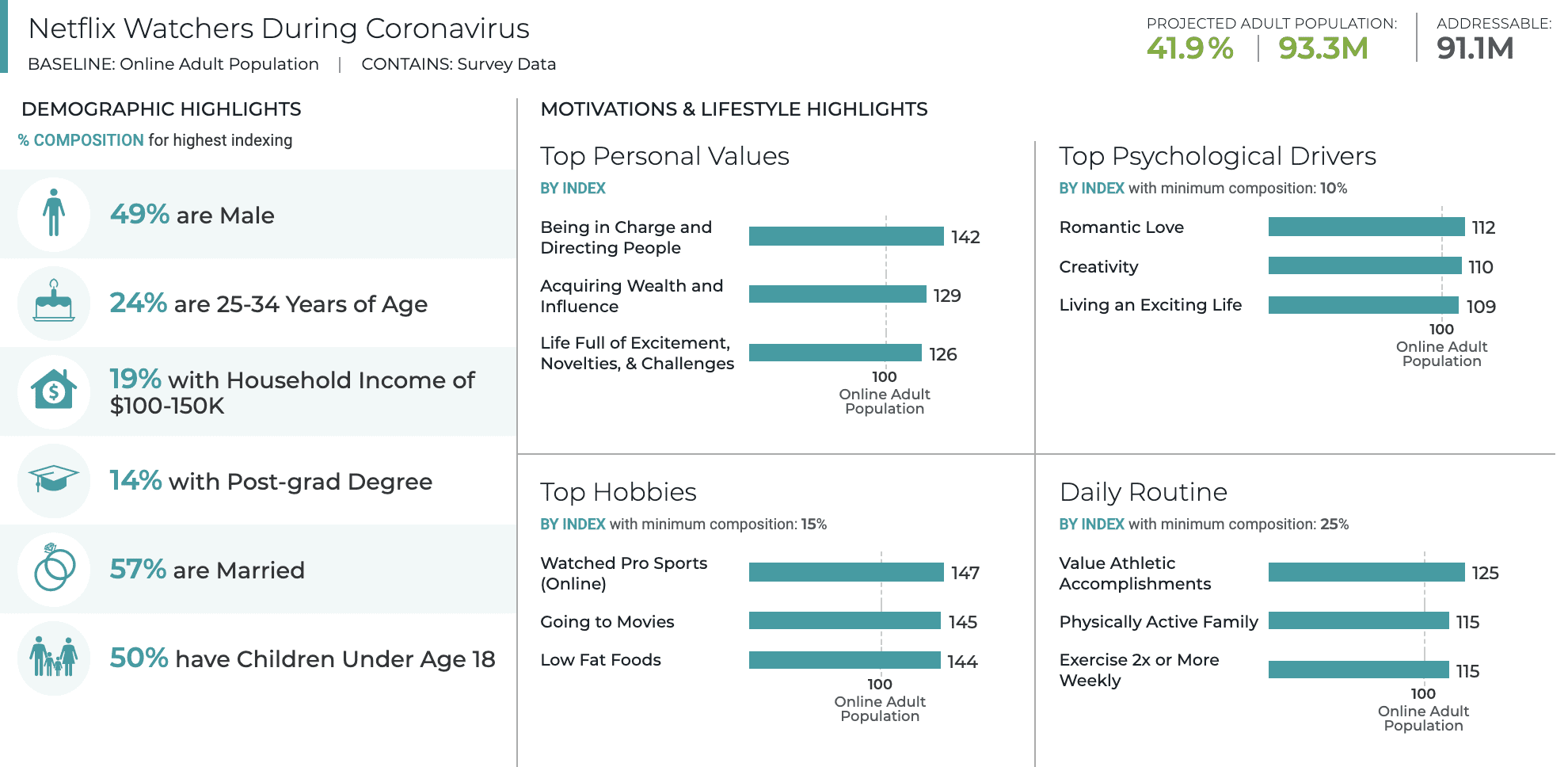

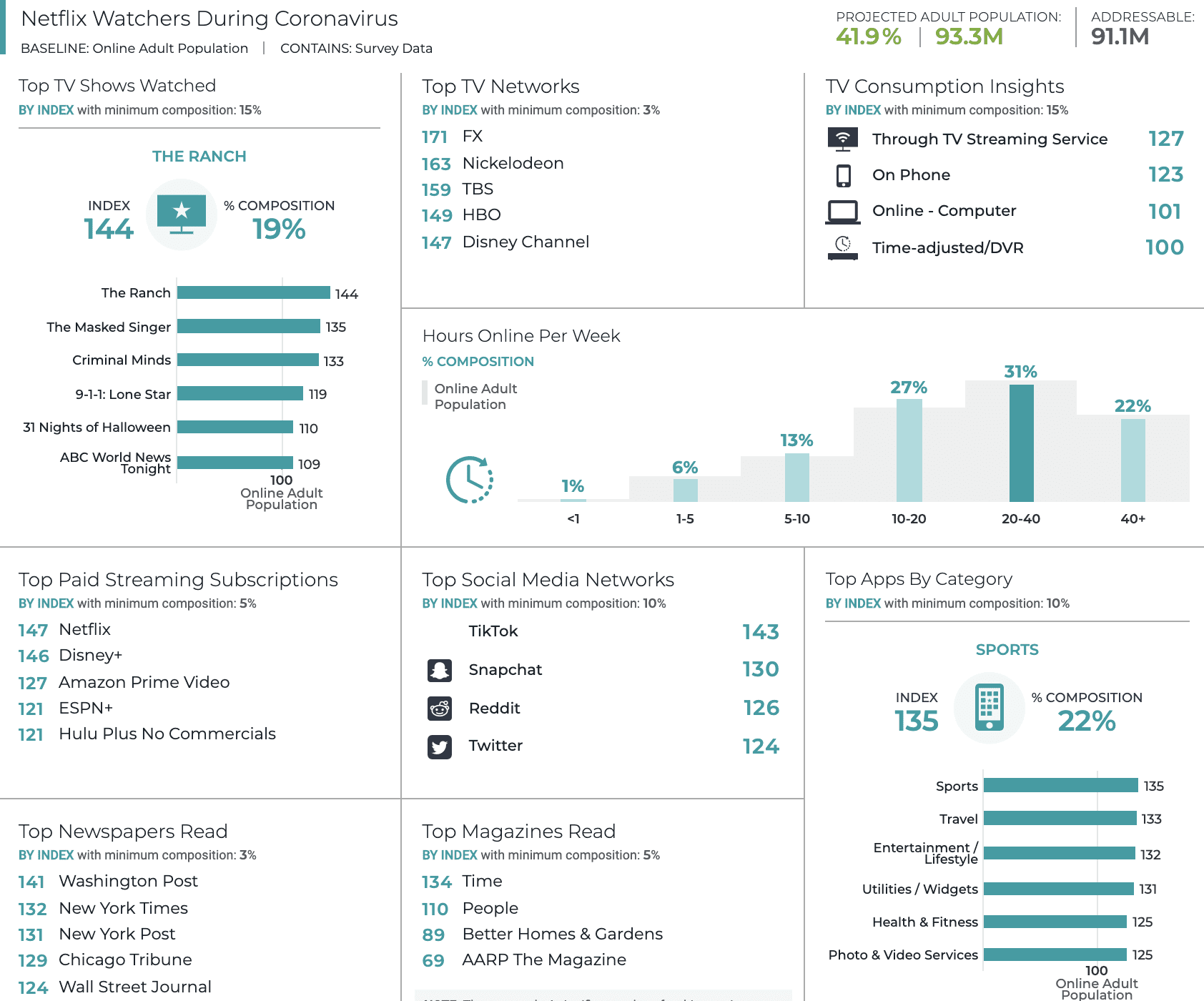

Given that Netflix is the network pulling ahead, we did a deep dive into those consumers increasing their Netflix viewership during the coronavirus pandemic.

In the Ignite Platform, we see consumers are almost evenly split male and female, 24% are between 25 and 34 years of age and 50% have children under 18. They are more likely to watch pro sports online as well as go to the movies, so we know they are a group that is tuned into media even in non-pandemic times. They value being in charge, acquiring wealth and living a life full of excitement, so Netflix could serve as escapism or inspiration for the life they hope to manifest.

We also see that these consumers are more likely to value athletic accomplishments, have a physically active family and exercise 2X a week or more. Could it benefit Netflix to consider how they could align a subscription with a virtual fitness provider?

Not surprisingly, this group is 27% more likely to watch TV through a streaming service, though they’ll also watch on their phone. 42% of them binge watch TV often or always, so a focus on binge-able series could be a win for Netflix and other streaming services during this time.

What shows are they most likely to tune in to on Netflix? Orange Is the New Black, The Ranch, Ozark and Arrested Development are among the favorites. It’s all about those bingeable series! And, when it comes to movies, they’re tastes are diverse: action, comedy and adventure all capture close to 60% or more of this audience.

When they aren’t watching Netflix, they also watch Disney+, Amazon Prime Video, ESPN+ and Hulu Plus. The top apps on their phone include sport, travel and entertainment, so their show preferences could align with these categories. If Netflix is looking to reach similar consumers to those who are already subscribers, they could consider advertising on social through TikTok, Twitter or Snapchat.

Lastly, if you’re wondering how to keep these streaming viewers streaming, think about why they cut the cord on cable to begin with: they’re 41% more likely to say it was because they didn’t want to see commercials and 43% more likely to say it was for the show and movie selection. So, keep that high quality, commercial-free programming coming and they’ll stick around.

Even In a Work From Home Environment, Streaming Music is Seeing an Uptick

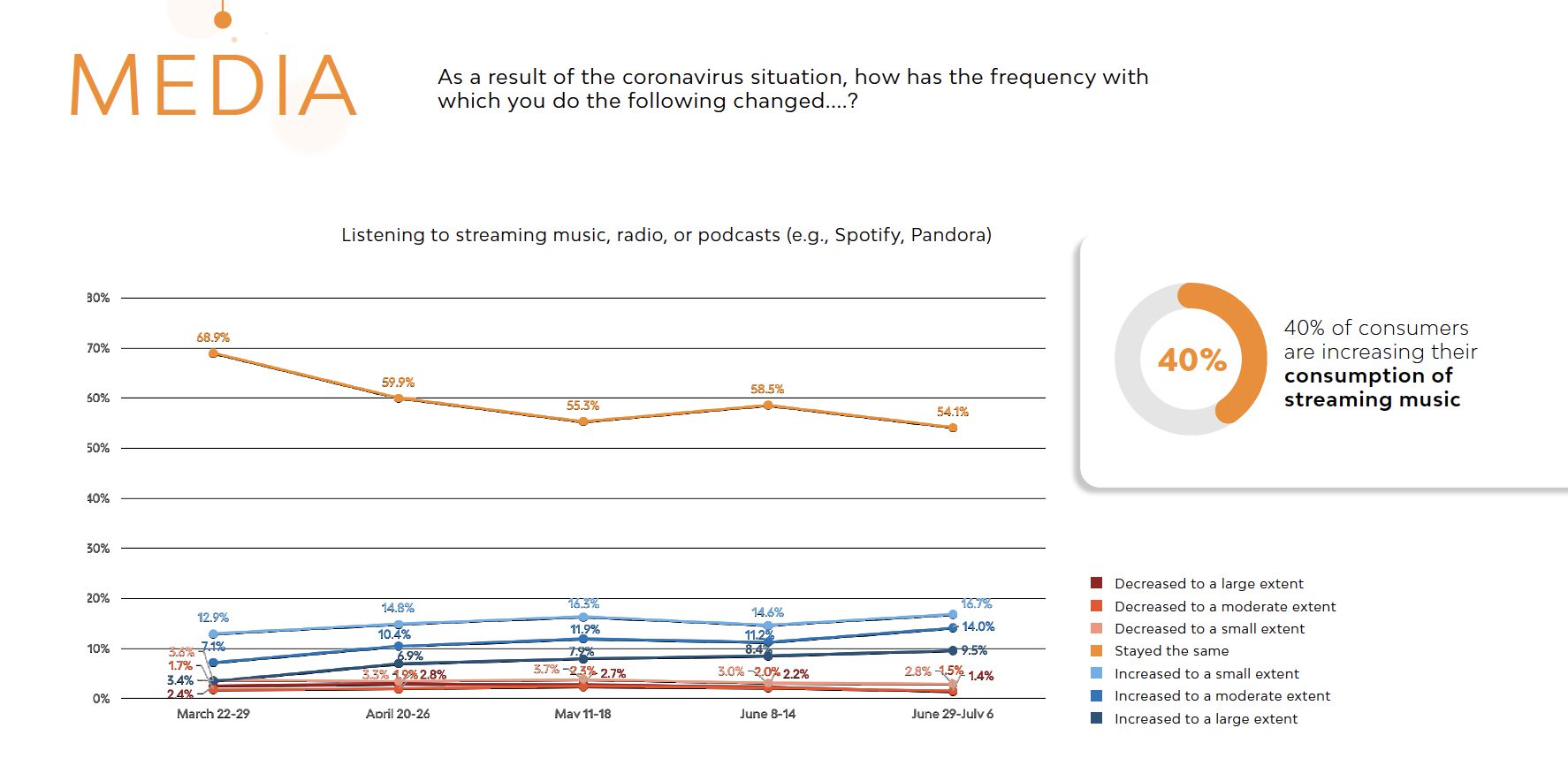

In the first months of social distancing, we saw small increases in consumer consumption of streaming music, radio and podcasts. When compared to the dramatic numbers we saw in streaming TV, many researchers attributed this to the decline in commute time for office workers. If you’re not driving 30 minutes every day or hopping on the subway, you might be less likely to plug in your ear buds and listen to your latest playlist. But, consumers do crave familiarity and, hey, it’s nice to have music playing when you cook dinner in…again.

In July, we saw the highest number of consumers increasing their frequency of listening to streaming music, radio and podcasts: 40%. That’s compared to only 23% back in March.

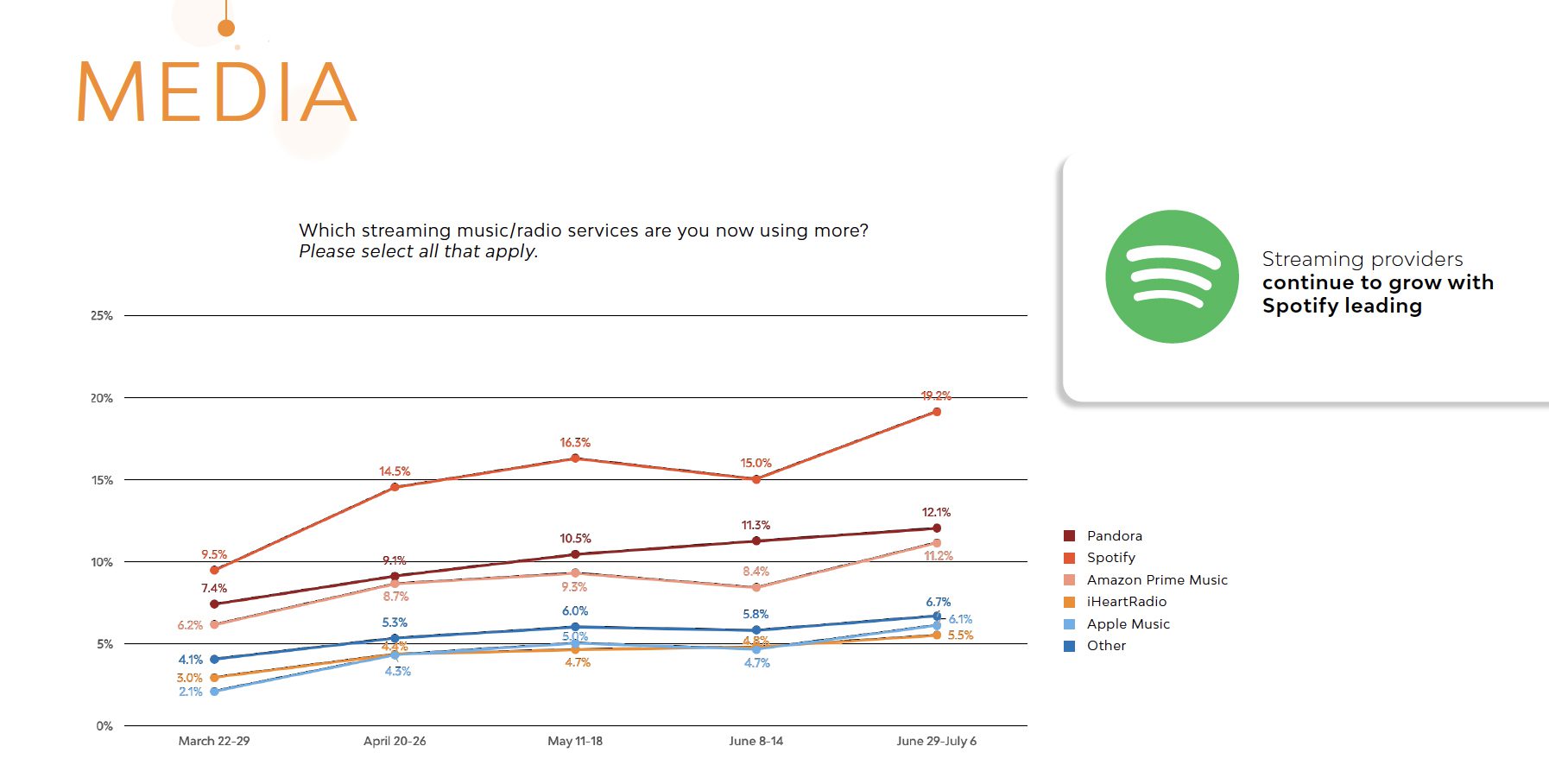

When we look at what consumers are listening to, Spotify is leading the way. In March, 9% of consumers said they were listening to Spotify more often but, in July, that had increased to 9%.

In July, however, all services actually saw an increase across Pandora, Amazon Prime Music, iHeart Radio and Apple Music.

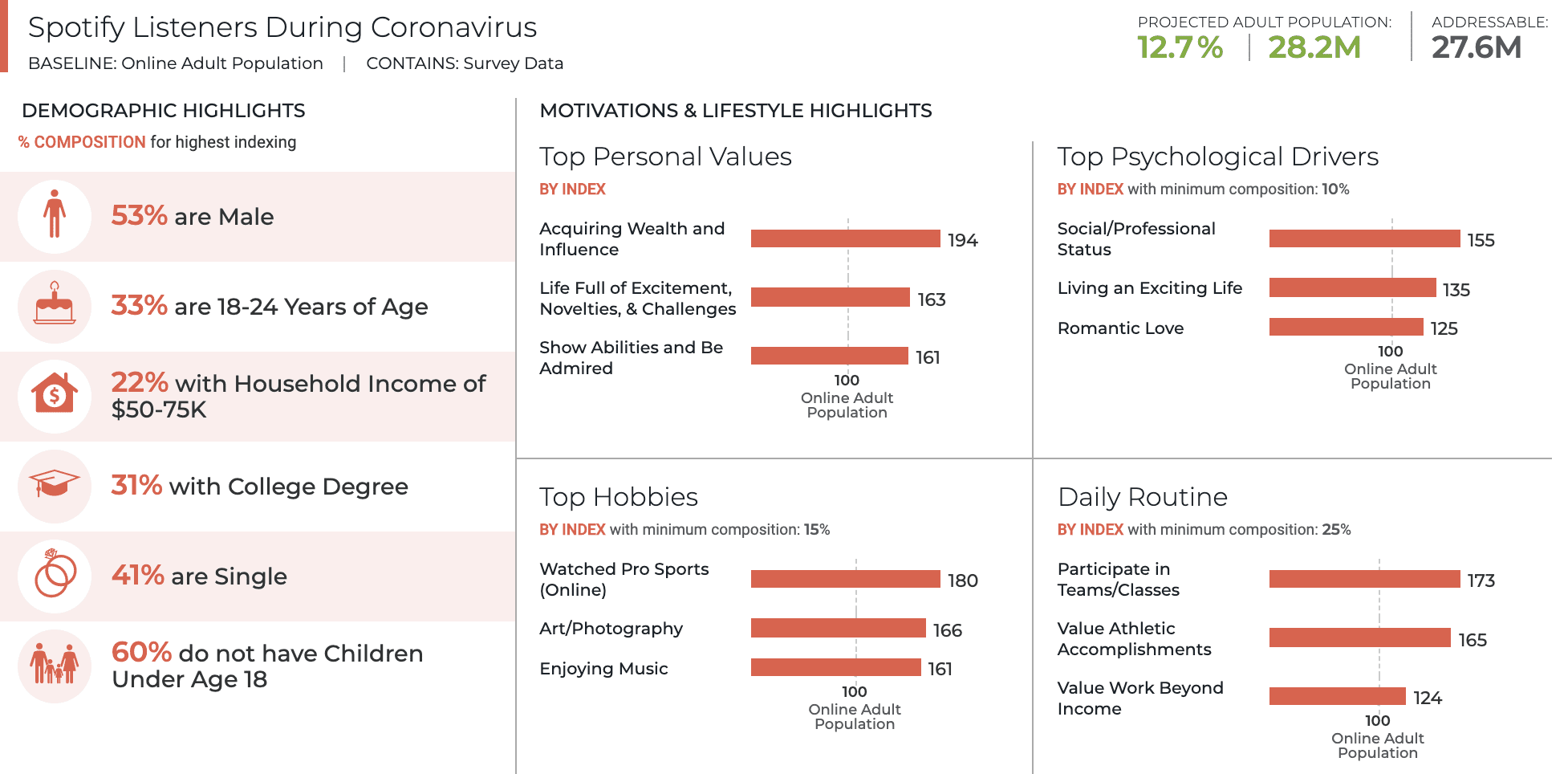

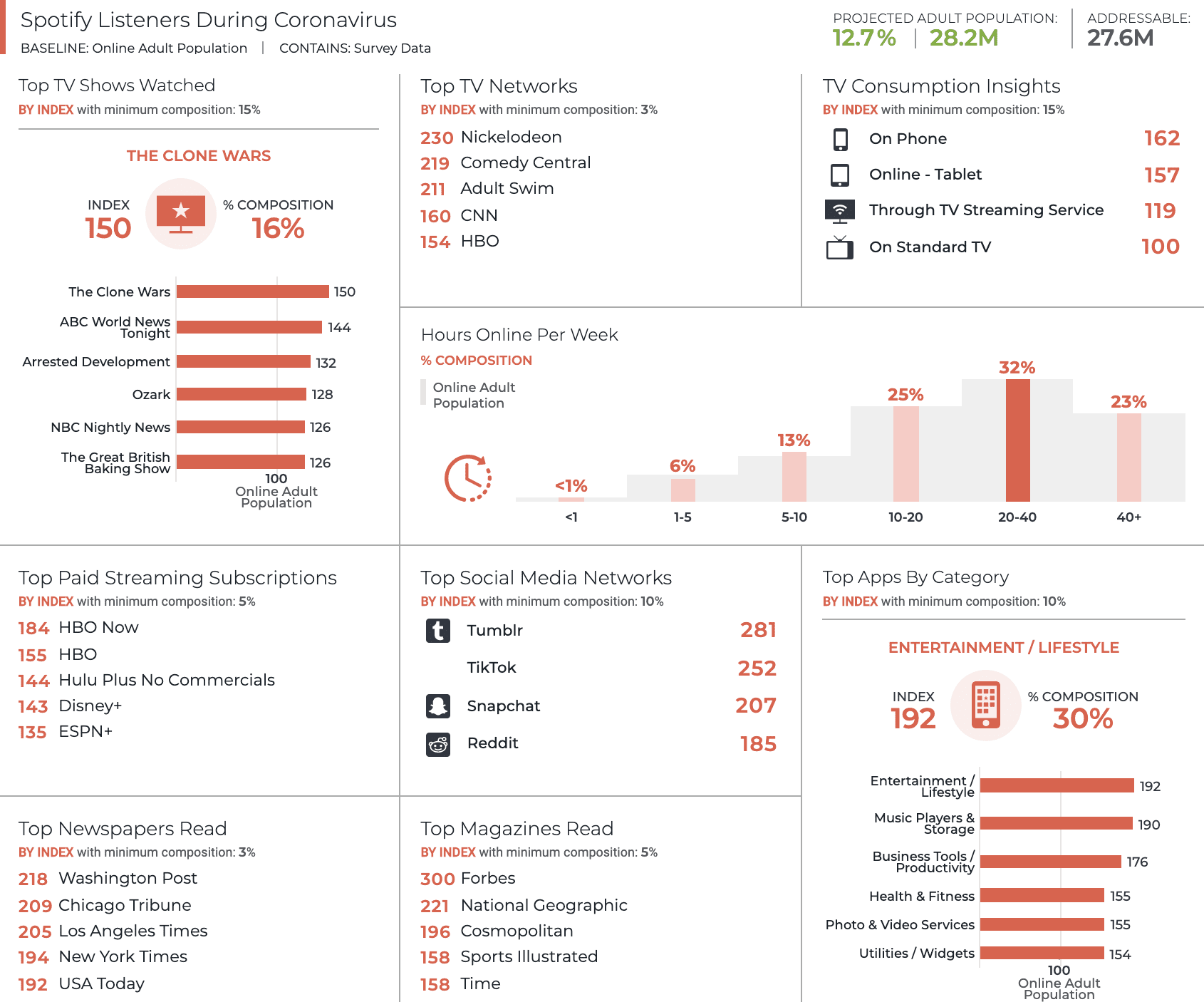

For the purposes of this research, we looked deeper at Spotify listeners given they’ve seen the most significant increases. Spotify listeners are 53% male and 33% are between 18-24 years of age. Their top values are acquiring wealth, living a life full of excitement and showing abilities. They watch pro sports online, enjoy art/photography and, of course, enjoy music.

Considering their interests in sports and art, how could Spotify find an overlap with those verticals? Could curated playlists by favorite athletes bridge the gap listeners are missing while sports are on hiatus?

When Spotify listeners don’t have their earbuds in, they’re watching HBO Now, HBO, Hulu Plus, Disney+ or ESPN+. They are significantly more likely than the average consumer to use Tumblr, TikTok, Snapchat and Reddit. This group spends plenty of time online with 55% spending over 20 hours a week online. On their phones, they spend the most time on entertainment/lifestyle apps and music apps.

For Spotify, this could mean that a partnership with an entertainment company or celebrity could prove resonant with their primary listenership.

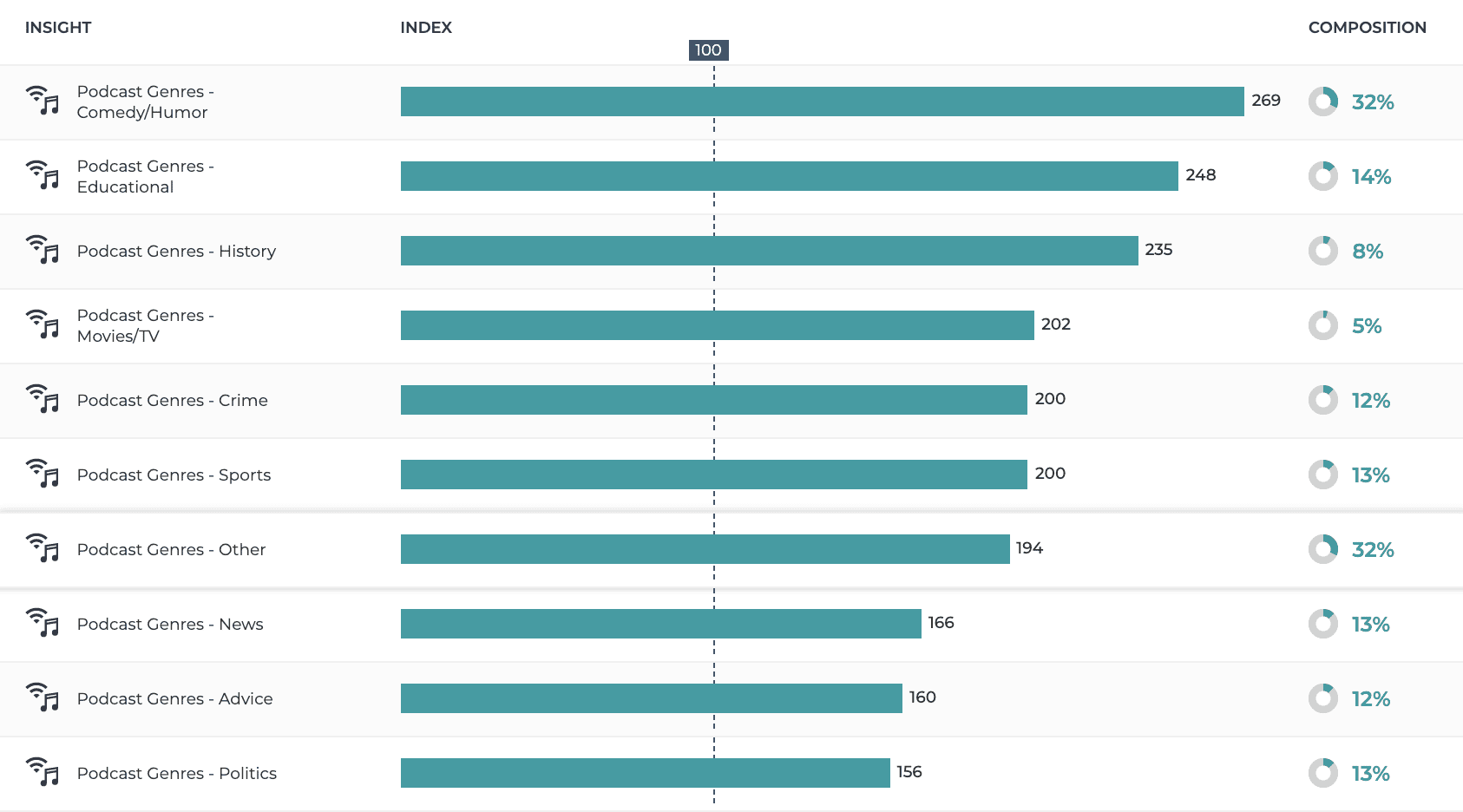

And, since Spotify isn’t solely a music platform, let’s look at podcasts. 59% of the consumers whose Spotify listenership has increased during coronavirus indicate they listen to podcasts. With a majority of these listeners tuning in to podcasts, how can Spotify target these listeners? They are 169% more likely to listen to comedy, so putting comedy podcasts front and center could be a safe bet, particularly if they are looking at an algorithm that focuses on introducing listeners who haven’t yet become podcasts listeners. Educational and history podcasts are also popular among these listeners.

Lastly, these Spotify listeners are 38% more likely to support companies that donate to charities and 49% more likely to support companies who support the community. Spotify’s move to create the “Spotify COVID-19 Music Relief Fund” will strike a chord with this group. The musicians that bring so much to their lives are struggling in the absence of concerts and tours and, with this move, Spotify shows to consumers that they are concerned with more than just their bottom line – they’re looking out for the livelihood of the artists. Given the rise of the activist consumer, this act will cement Spotify’s relationship with their listeners and increase brand loyalty.

How Will Streaming Services Continue to Evolve Throughout the Pandemic?

As consumers continue to stay home, Resonate will be closely tracking their media consumption habits. We know that consumer sentiment is rapidly shifting and, as you see in the numbers above, what proves true in one month does not necessarily predict what will happen the next. That’s why it’s essential to make sure your data is always real-time and continuously updated –– as Resonate’s is with over 10 billion daily online events. Want to learn more? Request a demo today.