What Can We Expect From Summer Travel During the Pandemic?

The [typical] summer travel season has arrived. But, what will beach vacations and trips to see grandparents look like during a global pandemic?

We last looked at sentiment around travel and the COVID-19 crisis earlier this spring, but, with new Wave 4 data just in and the Fourth of July holiday just days away, it’s time to revisit where consumer attitudes regarding travel are today. Resonate’s data is real-time –– we know that consumer behavior is rapidly evolving during these unprecedented times and using data from a month ago doesn’t cut it.

And, it turns out, after spending months at home, almost half the population is feeling a-okay about hitting the road for a quick warm weather getaway: 48% say they’d feel safe traveling in-state after reopening and 43% would feel safe traveling out-of-state. Not surprisingly, approximately 30% of both of these groups expect their travel plans to resume as normal this summer with an additional 30% in each group counting on Fall 2020 as their return to travel.

So, who are these consumers and, if you’re a travel or hospitality brand, how do you reach out to them in a way that is sensitive to the pandemic at hand, reassures them of safety policies in place and empathetic to the risk assessment that travelers must make before committing to their summer travel plans?

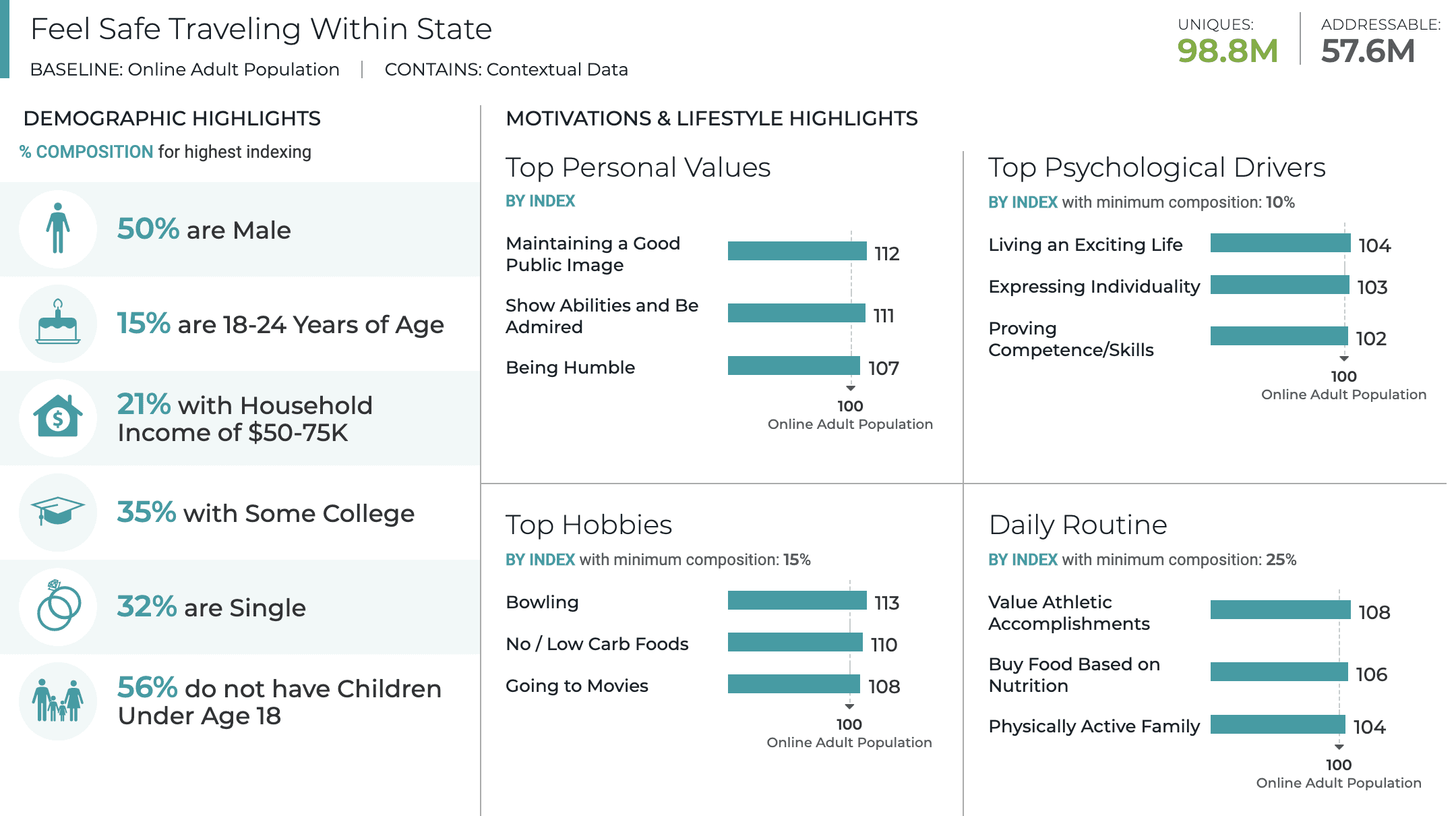

99 Million Travelers Feel Safe Traveling In-State

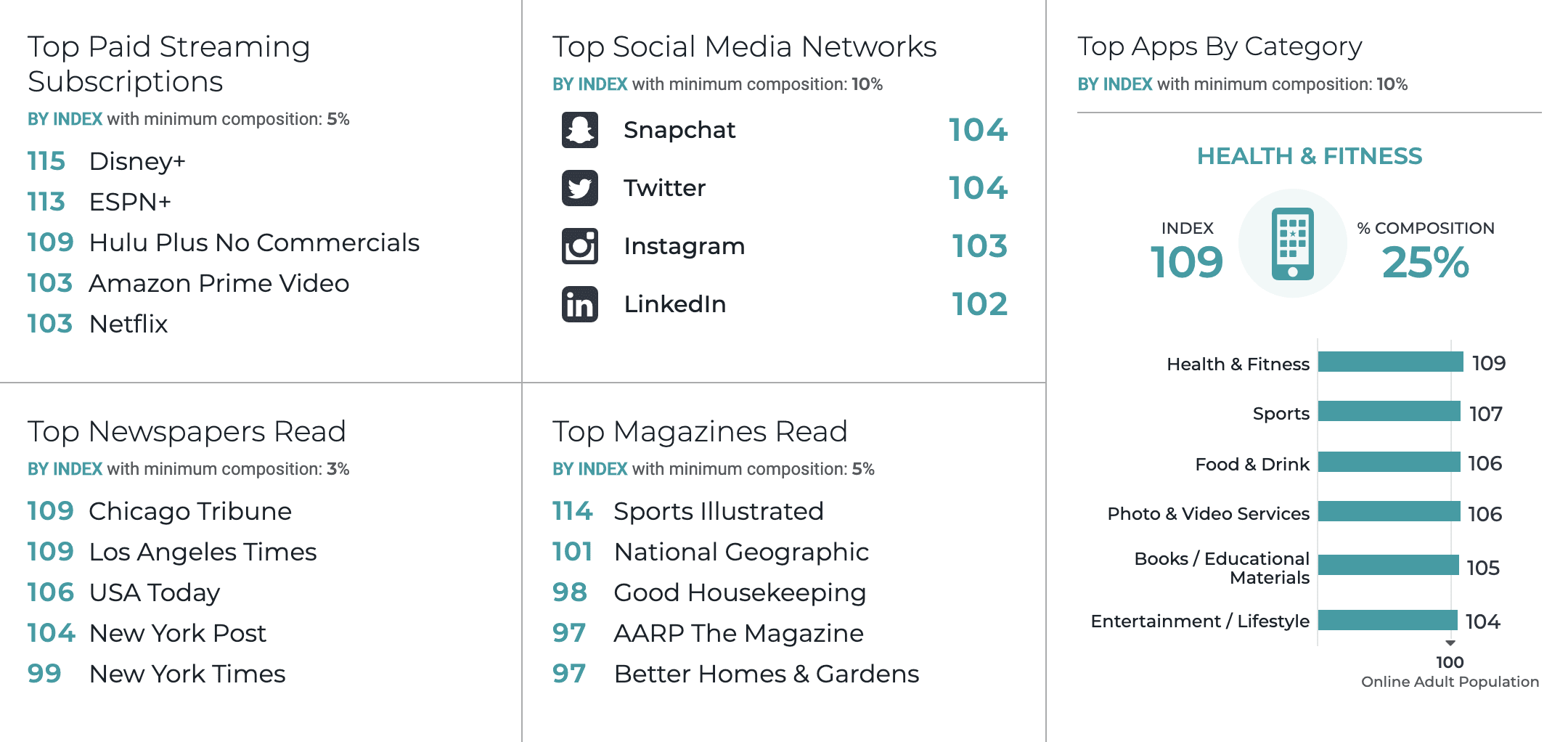

Of those who are ready to venture out on a short in-state trip, they’re equally split male and female, 56% do not have young children and 21% have a household income between $50-75K annually. 19% are between 24 and 34 and another 19% are between 35 and 44, while 18% are between 45 and 54 years of age. Your target audience is wide when it comes to age demographics, but your focus is on millennial and Gen-X travelers.

This group is likely torn between their desire to maintain a good public image…while also wanting to live an exciting life. They want adventure! But, they also know that the optics of ignoring calls for social distancing could be problematic. A short, in-state trip –– maybe to somewhere new to them? –– could be a good compromise between their personal values and their psychological drivers.

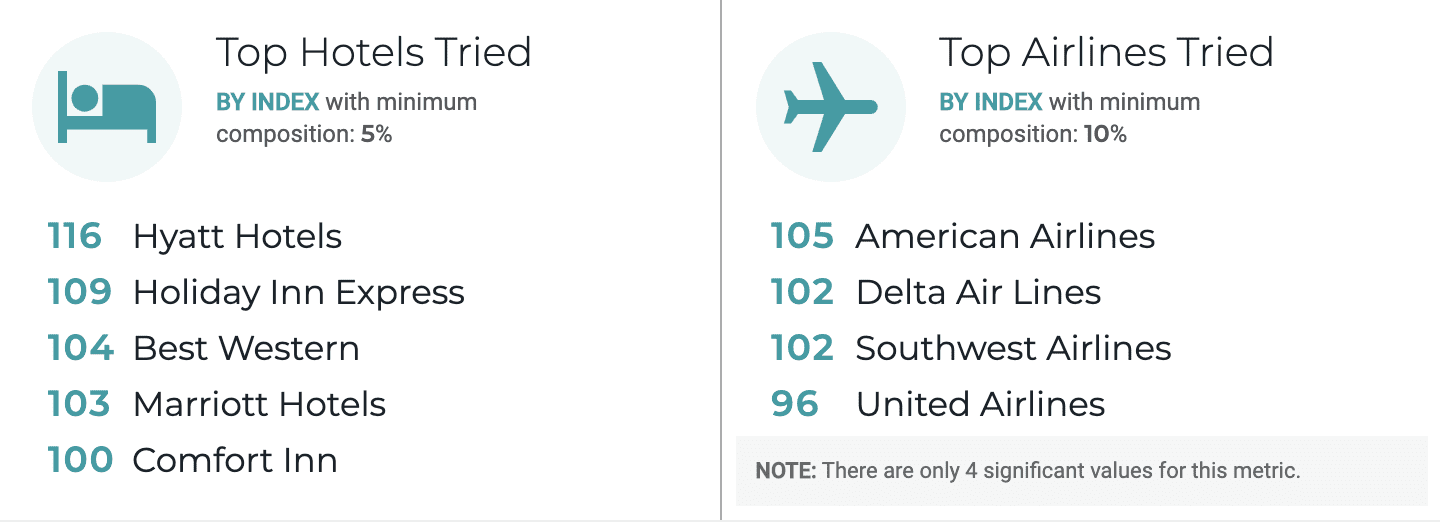

This group is 16% more likely to stay at a Hyatt (61% of them have!), but they’re also 23% more likely than the average American to have stayed at a Ritz-Carlton –– which lines up with the fact they’re 31% more likely to pay more for luxury. If you’re targeting this group, make sure your Wi-Fi is strong: 34% need communication access when they travel. They are also 28% more likely to want travel products that are the best looking –– how can you freshen up your spaces and products to stand out from the crowd?

47% are a member of one or more travel loyalty programs, so this could be a group to bring in with summer promotions. How can you make a stay with your hotel chain or booking a flight seem even more enticing with points or miles? Now’s the time to run that stay two nights, get one free promo! Especially considering they’re 28% more likely to say discounts and sales will influence where they travel. Also, 42% book directly, while 31% book through a travel site.

When they hit the road, 45% are traveling to spend time with family, while 29% are traveling to relax. 46% want a convenient location when selecting a hotel (though, you may want to consider weighing convenience v. social distancing precautions during this time!). Additionally, these could be quick trips: 44% say their leisure travel is typically less than a week. An easy long weekend getaway in a convenient to go to location and relaxing vibes could be the best bet for this group.

And, if you’re marketing to this group of in-state travelers, where will you find them? They’re 15% more likely to use the Disney+ streaming service and 13% more likely to use ESPN+. They’re more likely to be on Snapchat, Twitter or Instagram, while they tend to read Sports Illustrated or National Geographic. If you’re looking at in-app ads, consider active apps, including those in the health & fitness, as well as sports verticals.

90 Million Travelers Feel Safe Traveling Out-of-State

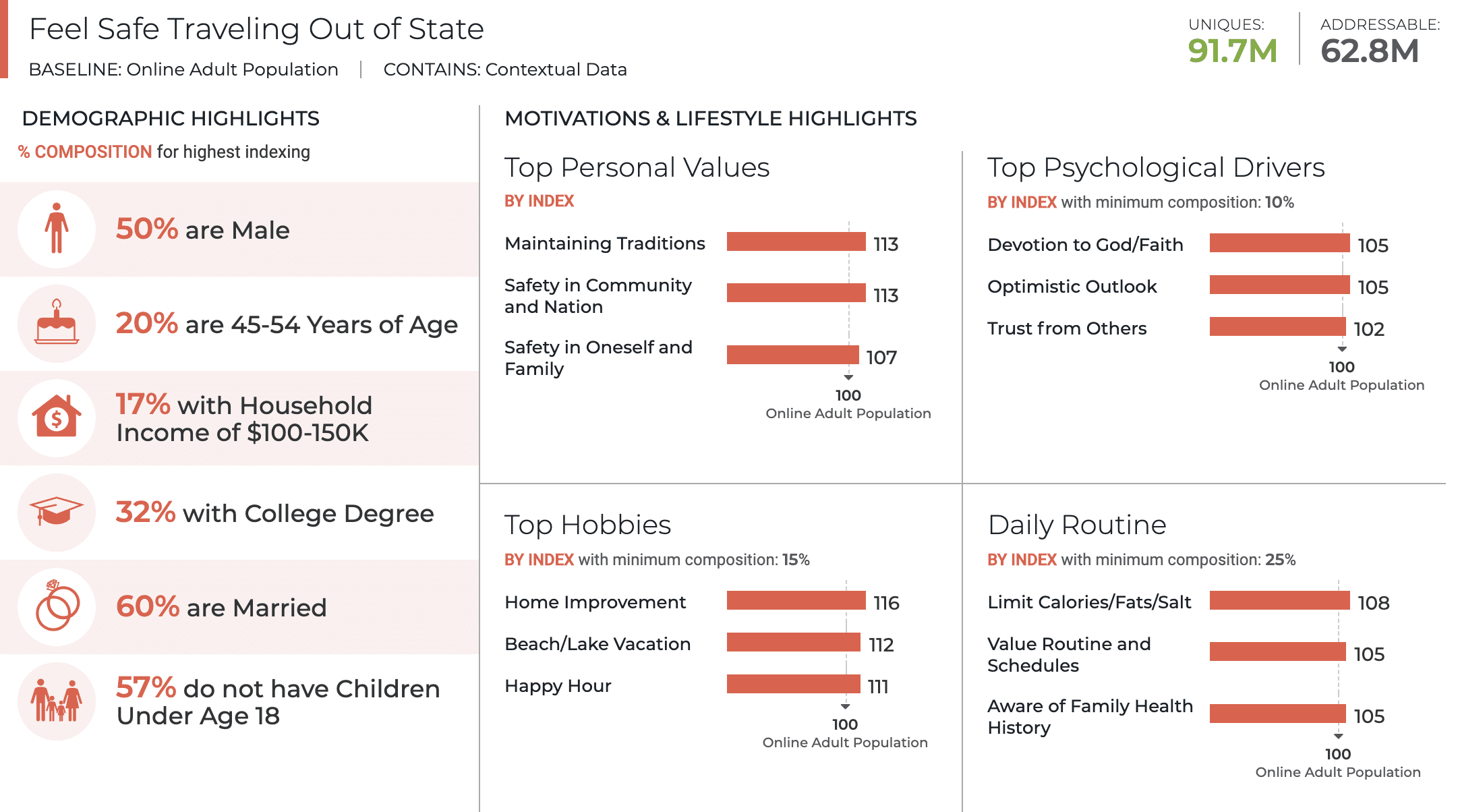

When it comes to those who are feeling ready to travel out-of-state, the group is still equally split male and female and 57% do not have young children. 17% have a higher annual household income at $100-150K. This group trends slightly older, with 20% between 45-54 years of age.

As we might expect, they are more likely to cite a beach or lake vacation as one of their top hobbies. They are more likely than the average American to have an optimistic outlook on life, which may be why they feel comfortable taking a cautious risk by traveling. They also are more likely to value safety in community and nation, as well as safety in oneself and family, so it seems that this group, while they are willing to introduce some risk by leaving home, they will do so in a way that keeps in mind the safety of themselves and those around them. Perhaps they’d feel most comfortable taking a trip to a remote lake or a beach house where they can socially distance once they have arrived.

29% of this group is willing to pay more for luxury, while 33% need communication access. 41% also cite wanting travel products that are trustworthy, while 47% are a member of one or more travel loyalty programs. When you combine trust with travel loyalty, you have a group that may feel most comfortable booking through a brand that they are familiar with –– particularly when many people are feeling uneasy about travel in general.

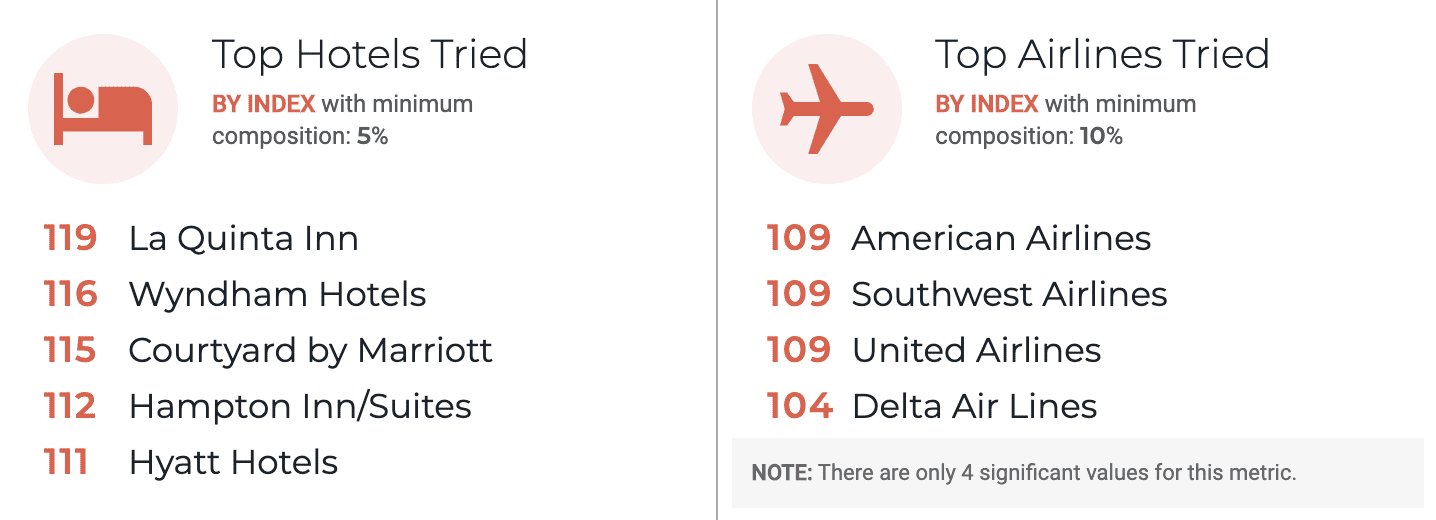

They are more likely than the average American to have stayed with several hotel names, including La Quinta, Wydham, Courtyard by Marriott, Hampton Inn and Hyatt. If you’re one of these brands, this is a group to target in the months ahead. They’re also 23% more likely to say that discounts and sales influence their travel decisions, so, similar to the other group, this is one to market summer promotions to. Additionally, 45% book directly, while 31% book through a travel site.

When traveling, 46% of this group travels to spend time with family, while 31% look to relax. Do you have properties in convenient waterfront locations that will merge their love of lake/beach vacations with the space to come together for a long weekend of relaxation? This could be your sweet spot for a group where 47% say convenient location is a main consideration for booking a hotel and 48% typically spend less than a week on leisure travel trips.

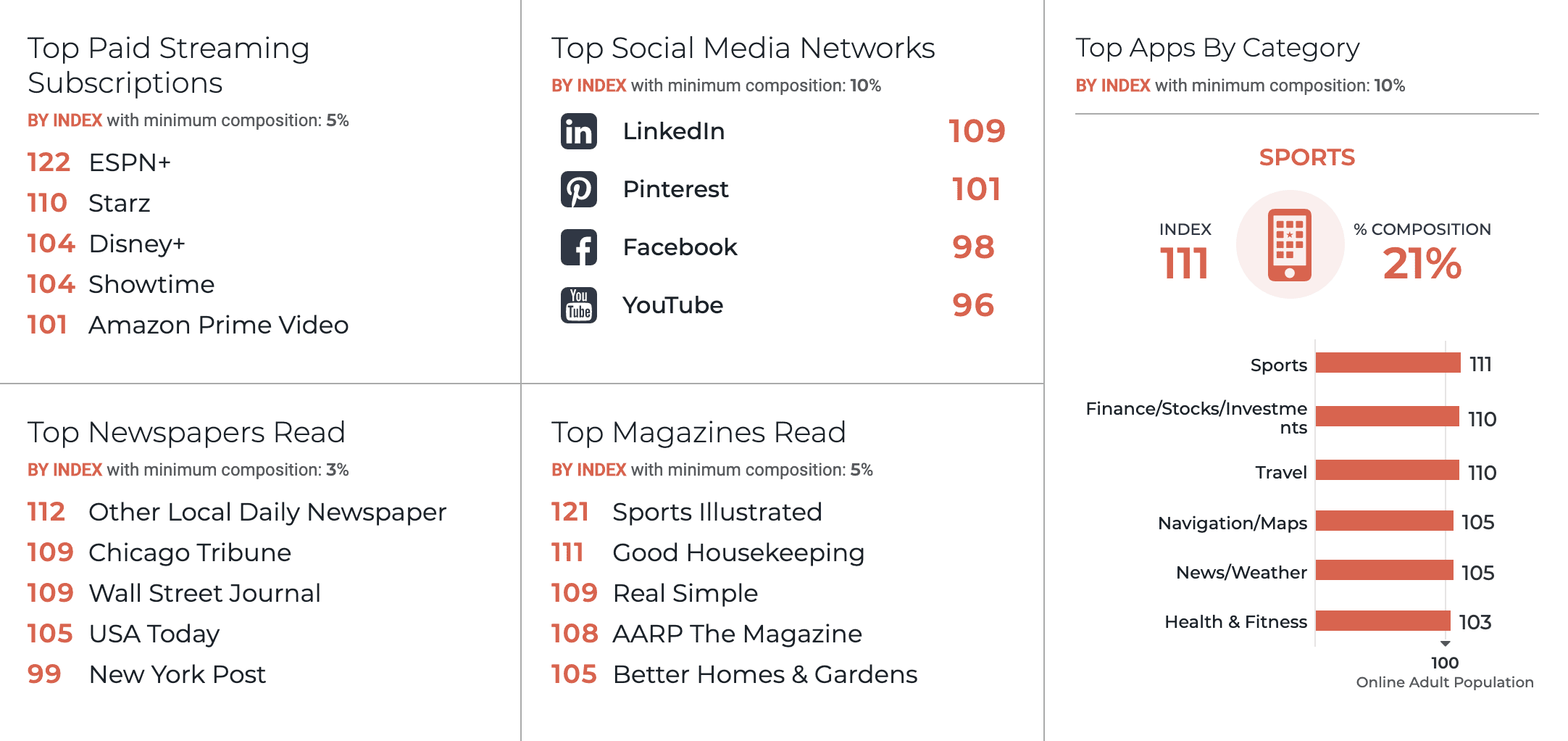

And, when you’re advertising to this group, consider that they’re more likely to read the local daily newspaper –– how can you pitch your destination to a local journalist? Or are there opportunities to place sponsored content? Lastly, they are 10% more likely to have travel apps on their phone, so think about opportunities to incorporate your travel loyalty program with an app that will put you literally in the palm of their hand.

Travel Won’t Look the Same in 2020, But Don’t Miss an Opportunity

We know travel is going to look different this year. Some consumers will avoid travel altogether until there is a vaccine. Others may delay plane trips. But, we also know that many consumers –– in fact, almost half –– are eager to itch the travel bug. Your play now is to figure out how to make short trips to nearby destinations just as exciting as that Caribbean vacay they may have cancelled.

Want more info on consumer sentiment in light of recent events? Download our Wave 4 report today: Marketing in the New Normal: Critical Data You Need Now.