Days spent at home has some of us looking to see what we can change in our homes.

A few weeks ago, we looked at U.S. consumers taking on outdoor home improvement projects during the coronavirus pandemic but, now, since it’s been raining for what seems like years, we’re headed inside to learn who’s ready to redecorate during coronavirus.

We broke these consumers down into three retail groups: those interested in purchasing new furniture, those looking to purchase new bedding or a new mattress, and, lastly, those researching DIY projects. Perhaps not surprisingly, these groups were similar in demographics, values and, most strikingly, shopping factors and product attributes.

It’s Time to Redecorate the Living Room, the Bedroom…

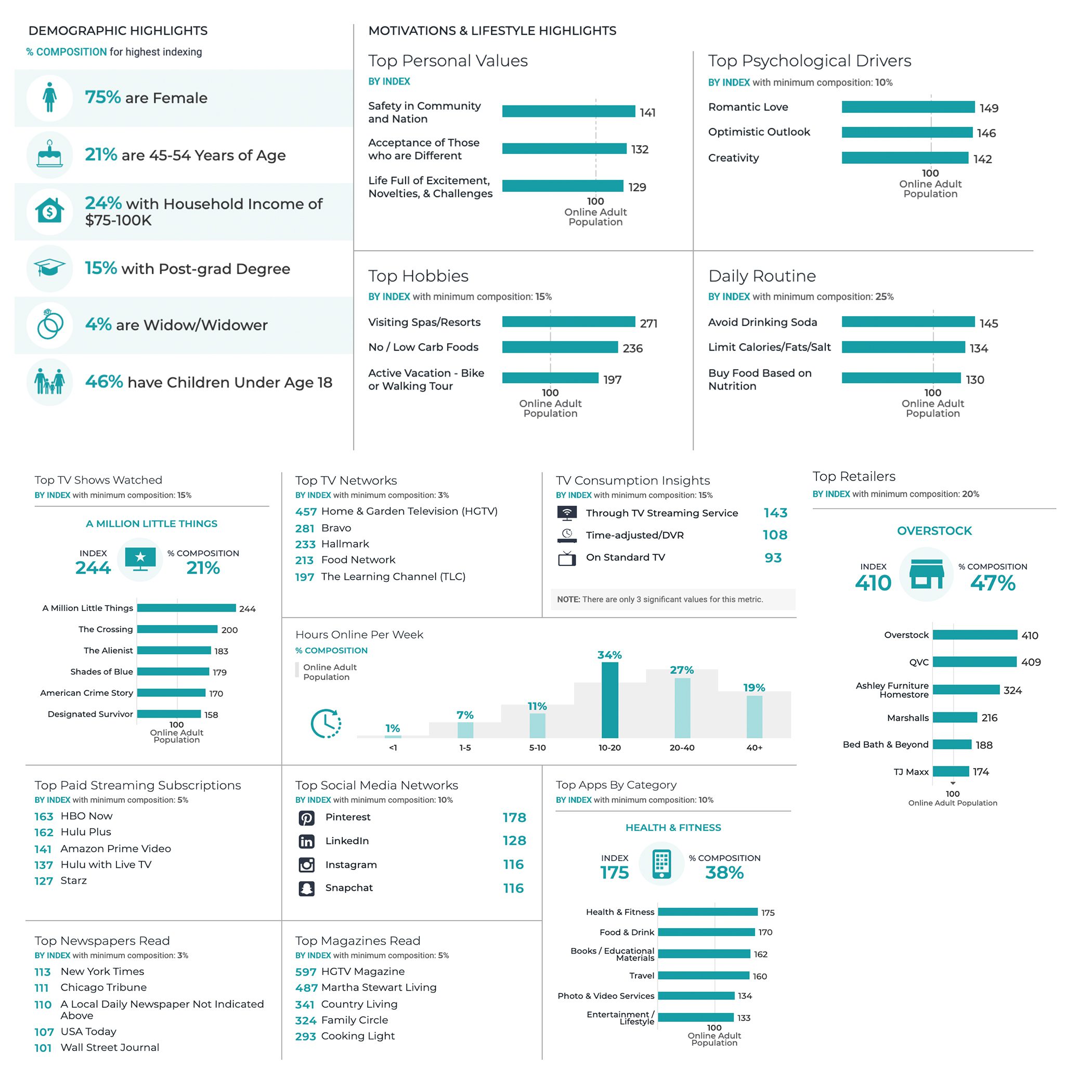

When we looked at people interested in purchasing new home furnishings, we saw a predominantly female group, a bit younger than the outdoor home improvement group at 45-54 years of age, with 24% in the $75-100K household income bracket. This group values optimism, creativity, and security –– they’re looking at the bright side of this situation by expressing their creativity in their own home and creating a safe haven from the uncertainty of the outside. We’ll see these values pop up in every group that we explore in this post.

This group spends their time watching HGTV, reading HGTV magazine and scrolling through Pinterest. Their top brands align with the home furnishing vertical, including Overstock, QVC, Ashley Furniture, Bed, Bath & Beyond and T.J. Maxx.

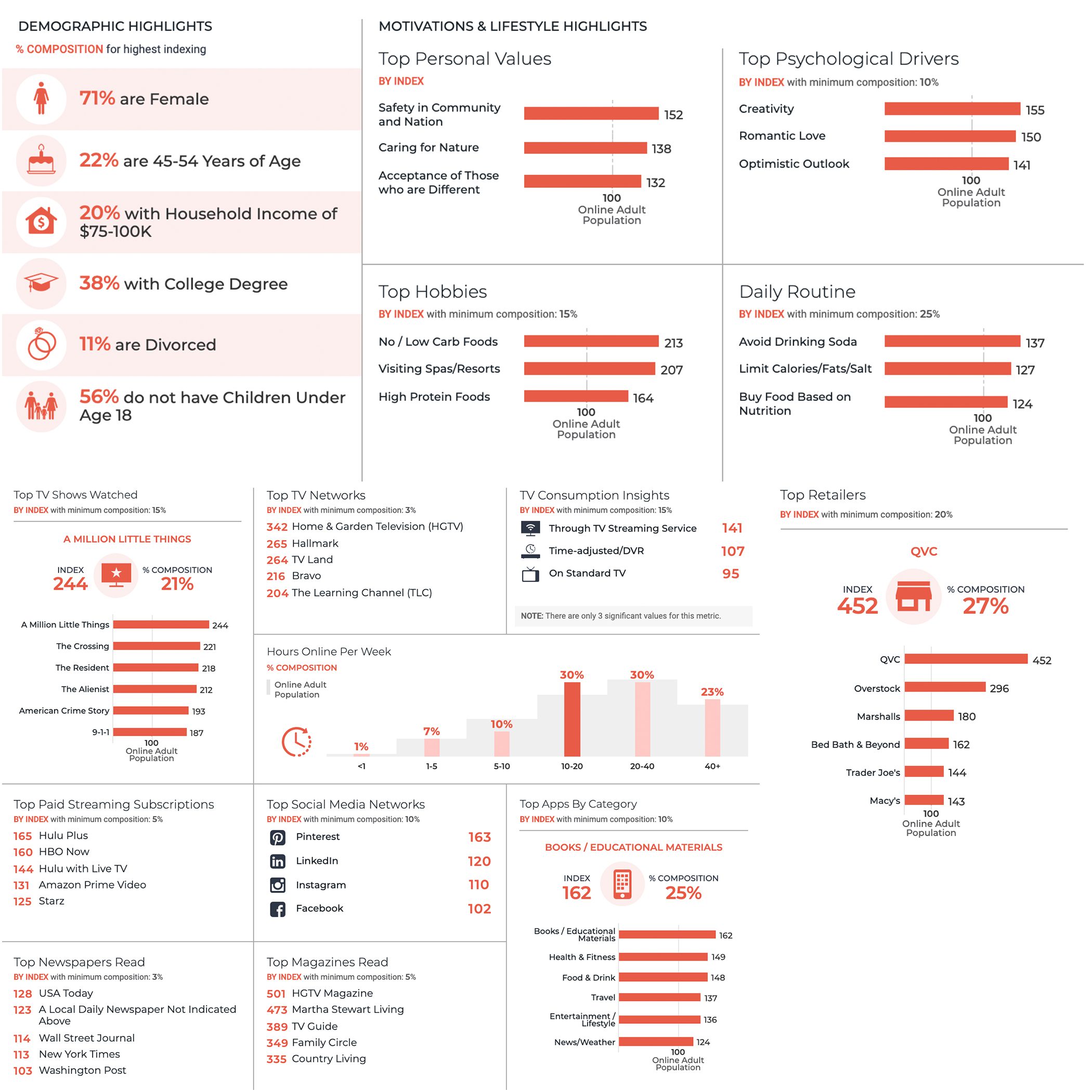

Next, we look at people who are researching buying new bedding or a new mattress. Hey, if you can’t leave home to travel, you might as well invest in making your bed feel like a hotel room, right?

As you’ll see below, this group is similar in demographics and values to the home furnishings group, and almost identical in brand affinity and media consumption.

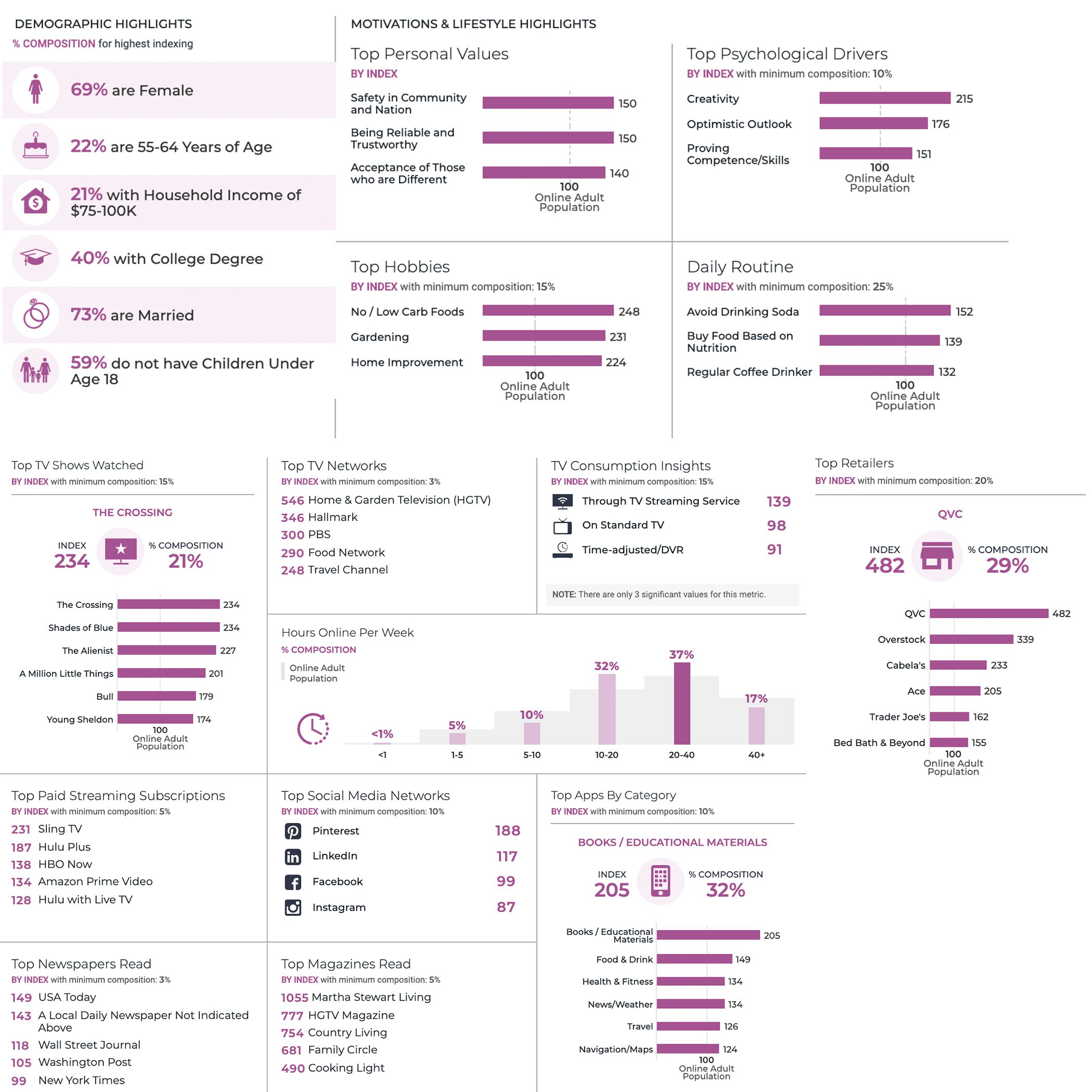

Lastly, we have the home DIY group. This audience is looking to take on home improvement projects, decor DIYs and more while they’re at home socially distancing. Again, they have similar demographics to the home furnishings and bedding group, but this group does skew a bit older. They align, at 55-64 years of age, more similarly with the outdoor home improvement group. This makes sense when you consider that someone who has the time to take on DIYs during this time could be more likely to be retired and without children at home that need to be entertained.

If You’re a Retailer, How Do You Market to These Segments?

Beyond knowing that you’ll find this audience scrolling through Pinterest, streaming HGTV, reading USA Today or reading their latest book on their phone, you’ll want to consider what motivates these consumers to buy. What makes them choose one sheet set over another?

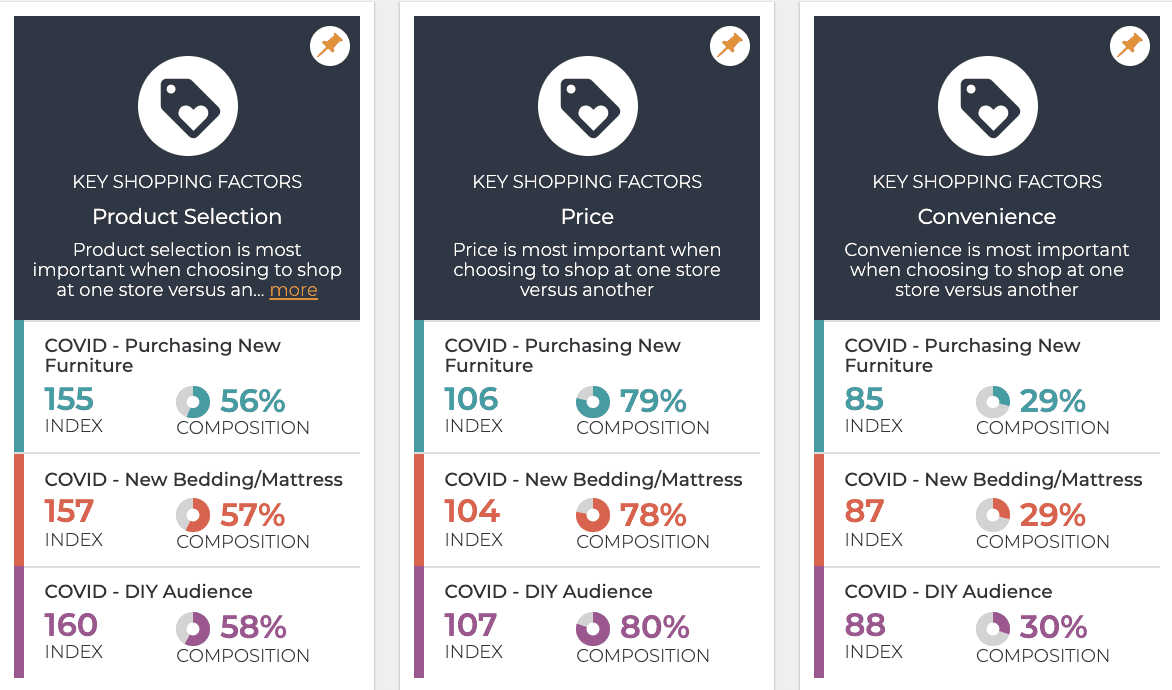

As we analyze the purchasing motivations that drive all three of these groups, we see they align almost identically –– one percentage point separated each group in three key shopping factors. They value price, product selection, and convenience.

When 80% of your prospective consumers look to price as their #1 shopping factor, you should look to sales and offers that will get them to your homepage. Your email marketing messages should lead with a deal. Clever or well-designed emails are great, but, at the end of the day, they’re looking for a well-priced purchase. Additionally, they want options –– scrolling through 5 pages of lamps on Overstock isn’t going to intimidate this group. For almost 60% of these consumers, more product selection available, the better. And, convenience. One third cite convenience as a key shopping factor. That two-day shipping or curbside pickup won’t go unnoticed. In fact, it could drive them to shop with you over a competitor with a less convenient purchasing process.

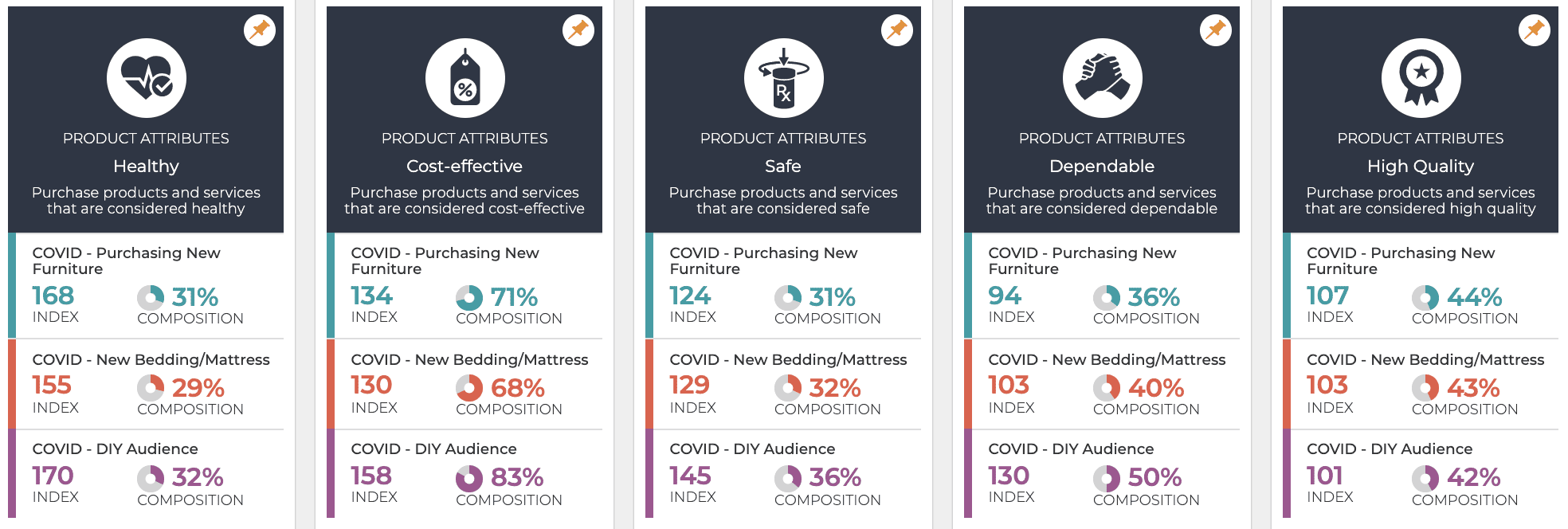

What product attributes do these shoppers look for as they’re redecorating? Relating back to the price shopping factor, this audience wants cost-effective products. However, they also want them to be dependable and high-quality. Just because something is a good value, doesn’t mean it shouldn’t hold up. They may not want to buy a new sofa every year –– they want something that will last.

They also want products that are safe and healthy. Consider how your products could be made with organic materials, extra safety precautions or how they might be “better for you” or better for the home than conventional options.

With a Target on the Right Audience, Home Retailers Should See an Opportunity as People Stay Home

It makes sense: as people are home for longer, they’ll begin to see changes they want to make in their space to make it more comfortable and more pleasant to be in day in and day out. And, if you’re a home retailer, that presents an opportunity. Consider how you can create products that focus on a cost-effective, dependable, safe lifestyle and will resonate with what your consumers are craving right now.

And, if what you’re craving is more data on consumers and the impact of COVID-19, download our latest data in the just-released Wave 2 report, Understanding the Evolving U.S. Consumer During the Coronavirus Pandemic.